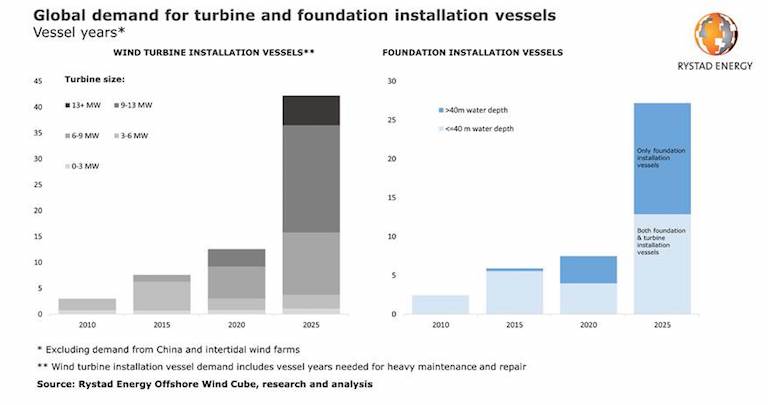

Offshore wind is booming, and as turbine and project sizes grow, demand for specialized installation vessels will soar. The market for vessels capable of installing large offshore wind components is quickly being outpaced by growing demand from the global development pipeline, a Rystad Energy analysis shows. The global fleet will be insufficient to meet demand* after 2025, opening room for more specialized vessel orders and other oil and gas heavy lift vessel conversions.

When translating the volume of offshore wind projects into vessel years for installation scopes, we estimate that the demand for foundation and turbine installations in 2020 is approximately 8 and 13 years respectively. On the supply side of the equation, there are currently 32 active turbine installation vessels (five more have been ordered) and 14 dedicated foundation installation vessels (another five have been ordered).

For the past few years, this has effectively resulted in a relatively oversupplied market, especially in Europe. However, the scale is clearly expected to tip towards an undersupply of installation vessels by the mid-2020s. With more offshore wind projects down the line, Rystad Energy expects installation vessel demand will be four to five times higher than today’s figure by 2030.

Moreover, there are currently only four vessels capable of handling the next generation of turbines, such as GE’s Haliade-X 12-MW (or 13-MW in boosted mode), which is expected to be commercial in 2021. As technology advances and future-generation wind turbines will get even bigger, the existing fleet of vessels is not likely to have enough capacity to install them.

“We identify the heavy-lift vessel segment as the key bottleneck for offshore wind development from the middle of this decade, and the need for next generation vessels may slow the cost reductions expected in offshore wind,” says Alexander Fløtre, Rystad Energy’s Product Manager for Offshore Wind.

In 2005, the average offshore turbine had a capacity of 3 megawatts (MW); projects expected to start up in 2022 now have an average turbine size of 6.1 MW. Moreover, as the cost efficiencies gained from using larger turbines are becoming an increasingly important driver of commerciality, Rystad Energy expects new projects will favor larger turbines over the smaller equipment seen in most offshore wind farms to date.

Many of the existing vessels have astonishing lifting capacities, inherited from their original purpose; installing and decommissioning large oil and gas platforms. These large lifting capacities are definitely a key strength to be leveraged but will have little significance if efficiencies (meaning vessel days per installed component) are not able to stay competitive. This is especially poignant as most offshore wind projects require the transit and accurate positioning of installation vessels at least 100 to 300 times in quick succession.

After turbine and foundation manufacturing, the installation phase is the most capital-intensive development process, consuming about 20% to 30% of total capital expenditures. For a 1 GW project comprised of 100 turbines, this could add up to $800 million to $1000 million, from which about 15-20% and 8-10% is earmarked for foundation and turbine installation costs, respectively.

Across the global fleet of installation vessels that Rystad Energy tracks, we have observed an average installation speed of 3-4 days per vessel per monopile. In contrast, the duration of turbine installation varies more widely at anywhere between 2-5 days, mainly due to the expected weather implications when lifting blades and hub components above significant heights in windy areas.

Naturally when it comes to hoisting heavy equipment over 100 meters from the water line, installation vessels must be able to carry out the job in a safe and precise manner. Offshore crane capacity, lifting height, and ample deck space are just some of the main competitive factors these units offer, and continue to evolve.

Between 2000-2010, the offshore wind market’s slow growth and relatively light equipment (2-4 MW turbines) posed no real challenge to the existing fleet. Yet in 2014-2015 turbine sizes began to increase substantially, especially in Europe, and with them the need for larger crane capacities and lifting height. Early players in the vessel market were able to anticipate this shift and optimize fleets to serve these larger projects. Nevertheless, it is evident that competitive features that were considered “high-spec” only three years ago are already outdated.

“Looking ahead, vessels will have to serve the initial construction phase of projects, in addition to maintaining and periodically replacing the active base of equipment. The segment that will succeed in serving the future needs of the offshore wind industry will be able to offer this valuable synergy to support a healthy fleet utilization,” Fløtre concludes.

*For the purposes of this analysis China and intertidal wind farms (mainly Vietnam) are excluded. China is predominantly making use of its local value chain, with little participation from foreign suppliers. Intertidal farms drive limited vessel demand.

Follow us on social media: