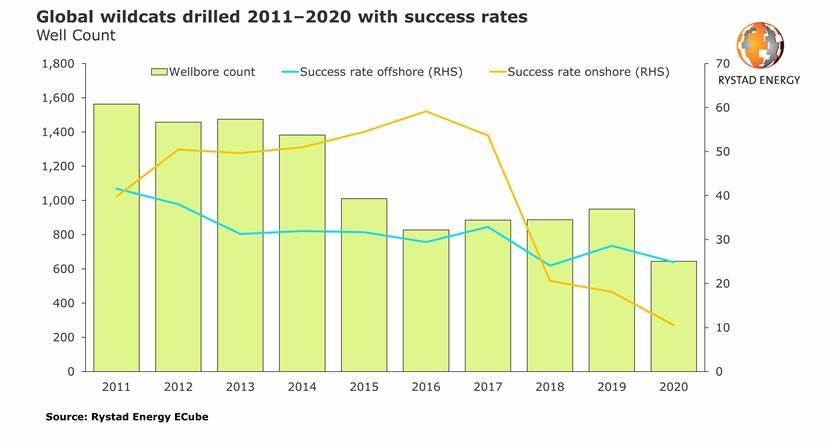

The success rate of global conventional oil and gas exploration has declined in recent years, but the most painful blow has been to onshore wildcat wells, a Rystad Energy analysis reveals. In 2020, the success rate of these drilled wildcats plummeted to an all-time-low of 10.6%, marking an annual decline for a fourth year in a row, another dubious record for oil and gas exploration.

During the first half of the last decade, the operators enjoyed high success rates in their wildcat drilling campaigns, of between 40-60% for onshore and 30-40% for offshore. Both onshore and offshore wells have seen a decline in success rates in recent years but for onshore the drop since 2016 – when explorers recorded nearly 60% success with their wildcats – has been particularly alarming.

For offshore wildcat wells it’s been more of a hit and miss. The offshore success rate has seen mild fluctuations during this decade and the 2020 score ended at 24.8%, down from 28.6% in 2019 but slightly higher than the 24.1% score recorded in 2018.

“The lack of availability of easily exploitable prospects, combined with dying exploration activity in once rich onshore areas such as the Middle East, have led to the decline in the onshore success ratio. Most of the easily mappable structural prospects with shallow reservoirs have already been thoroughly explored, leaving wildcatters to struggle primarily with technically challenging prospects,” says Palzor Shenga, vice president at Rystad Energy’s upstream team.

Rystad Energy does not foresee a significant improvement in the onshore success ratio soon and much more activity will be focused on offshore areas, where prospects are associated with higher unrisked resources. Deep and ultra-deepwater areas have delivered decent success over the past couple of years.

Although new volumes found in 2020 exceeded 10 billion barrels, only 12% of the wildcats had a volume potential greater than 250 million barrels of oil equivalent (boe). Of these, 66% targeted reservoirs in deep and ultra-deep waters, 20% were in onshore basins and the remaining 14% were in shallow waters.

In 2021, we expect around 70% of the high-impact wildcats to target deepwater and ultra-deepwater plays, while 17% are in offshore shelf areas and the remaining 13% are onshore. This indicates that the high-risk deep and ultra-deep plays continue to garner interest despite the decrease in exploration spending.

The number of wildcat wells has traditionally been higher in the onshore sector compared to offshore, as costs are lower, but with efficiency measures now reducing drilling costs offshore, the tables are turning.

From about 474 onshore wildcats in 2020, Rystad Energy projects the number to fall to 253 in 2021 and 270 in 2022, never exceeding 300 wells per year through 2025, which is as far as our forecast reaches. The number of offshore wildcats, however, is forecast to increase to 217 in 2021 and 300 in 2022, from only about 180 last year.

“Onshore wildcat exploration has reached a stage of decline, marking the end of an era. Prime locations have been nearly exhausted and, amid low success, the focus now is turning to offshore targets, supported by technological advancements, cost efficiencies and a much larger available selection of untapped areas,” concludes Shenga.

Follow us on social media: