Many planned US solar factories probably won’t be built as cheap imports from Chinese companies push global cell and panel prices so low that even federal subsidies can’t sustain domestic plants, a report warns.

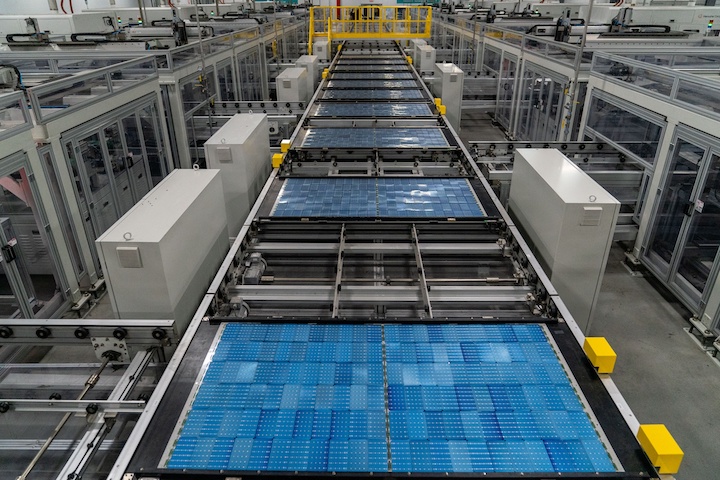

President Joe Biden has made bringing clean energy manufacturing back to the US a top priority, both to create jobs and fight climate change. The 2022 Inflation Reduction Act contained a subsidy of 7 cents per watt for domestic solar panel factories that use imported cells, triggering a wave of US plant announcements.

The subsidies, however, will not guarantee US factories make a profit because prices for panels available to the American market — including imports — are expected to plunge from about 23 cents per watt this year to 16 cents per watt by the end of 2025, according to a report from BloombergNEF.

“Global price pressures, and especially cheaper and cheaper imports, will result in many US factories facing a pretty rude awakening,” said BNEF analyst Pol Lezcano. “And it will probably lead to a lot of factory cancellations.”

In addition, the plants that open likely will use cells made with Chinese polysilicon because the material costs twice as much when sourced elsewhere, according to the report. The US has been keen to revive domestic solar manufacturing in part to shift its supply chain from China.

In response to the report, a White House official said the administration remained concerned about “overcapacity and overproduction by China” and would keep all options open, “including trade remedies.”

Changes to US policy and strong trade enforcement are essential to ensure robust solar manufacturing growth amid sustained imports from China-headquartered companies, said First Solar Inc. Chief Executive Officer Mark Widmar, who was scheduled Tuesday to speak before the Senate Committee on Finance.

“The US solar manufacturing industry remains in a precarious position despite the passage of the IRA,” Widmar said in prepared testimony. “The relentlessness of the Chinese subsidization and dumping strategy has caused a significant collapse in cell and module pricing and threatens the viability of many manufacturers.”

Follow us on social media: