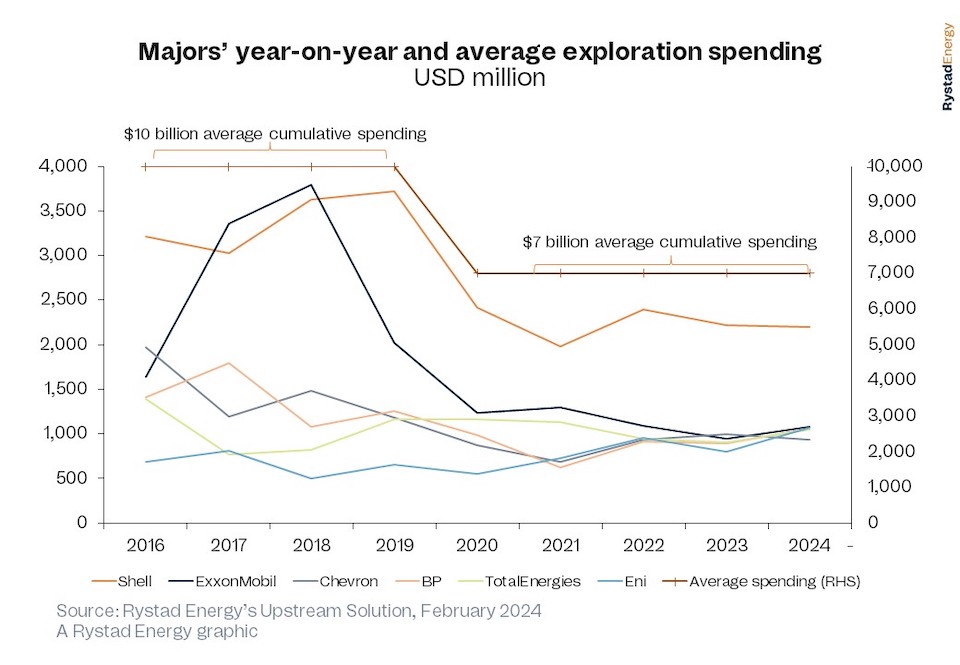

Oil and gas upstream majors — ExxonMobil, Shell, Chevron, BP, TotalEnergies and Eni — will continue to exercise caution in exploration spending this year, with drilling activity poised for a busy year ahead. According to Rystad Energy’s research, these major producers will have spent on average a combined $7 billion each year between 2020 and 2024, a sizeable drop from the previous four-year period during which average total spending was $10 billion.

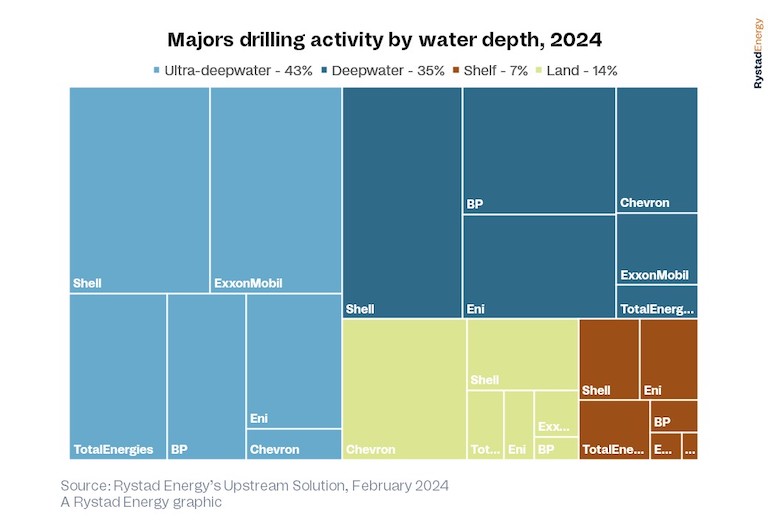

Despite tightened budgets, frontier drilling is fueling optimism for a productive year, particularly deepwater projects in the Atlantic Margin, Eastern Mediterranean and Asia. Last year saw a significant increase in awarded acreage to major players, totaling 112,000 square kilometers — an uptick of 20% from the previous year. Notably, all awarded blocks were offshore, with 39% in the shelf segment, 28% in deepwater and the remaining 33% in ultra-deepwater.

The trend suggests a significant push toward deeper waters, with more than half of the awarded blocks targeting deepwater or ultra-deepwater reserves. This focus is reflected in global exploration activity, with Rystad Energy analysts predicting approximately 50 more deepwater and ultra-deepwater exploratory wells this year compared to 2023. Approximately 27% of all offshore exploration wells drilled last year were deepwater/ultra-deepwater, while this year we expect the share of such wells to rise to around 35%.

"As majors tighten their financial belts, they're cautiously venturing into deeper waters and re-evaluating their approaches for frontier exploration. While we anticipate them to appraise and mature their frontier acreages, we also expect them to continue to focus on familiar territory — regions with established expertise and existing infrastructure that offer quicker monetization with lower risks,” says Santosh Kumar Budankayala, Senior Analyst at Rystad Energy.

Conventional discoveries plunged in 2023, with majors hitting a bleak 1 billion barrels of oil equivalent (boe), shattering the post-2020 recovery trend and representing a stark 68% drop from the 3 billion boe in 2022. Notably, frontier basins, which contributed 45% of discoveries in 2022, only accounted for 20% last year.

With dwindling discoveries, the future of oil and gas exploration likely lies in venturing beyond the familiar. Frontier and underexplored basins, teeming with hidden potential, offer the promise of substantial untapped resources. Unlike mature basins where exploration yields smaller, scattered finds, these new areas hold the allure of large, geographically concentrated prospects.

While recognizing the short lead time between discovery and start-up for finds made in mature basins, majors recognize the importance of frontier exploration. Over the past two decades, frontier exploration has yielded notable successes, such as the discovery of gas in Area 1/Area 4 off Mozambique between 2010 and 2013, gas finds off the coast of Mauritania and Senegal between 2015 and 2017, the Liza oil discovery in Guyana in 2015 and more recently the Sakarya gas field in Turkey's Black Sea sector in 2020. Additionally, discoveries such as Brulpadda and Luiperd in South Africa in 2019 and 2020 and Venus and Graff in Namibia, both in 2022, have led to the opening of new hydrocarbon plays.

A significant portion of the acreage awarded in frontier basins last year was in Uruguay, with Shell securing the largest single share at 42,000 square kilometers. Notably, more than 50% of Shell's awarded acreage came from Uruguayan territory. This is in contrast to the historical focus of major oil companies on mature fields, suggesting a potentially significant shift in Shell’s exploration strategy. While Uruguay accounted for nearly half of the total frontier basin awards in 2023, it remains an anomaly, as major players generally remain cautious in 2024.

Shell remains a key player in deepwater exploration and production, with significant projects slated for this year, particularly in Southeast Asia, Africa and the Americas. Currently, Shell is drilling the ultra-deep prospect Pekaka on Block SB 2W offshore Sabah, East Malaysia. This prospect shares similarities with the 2022 Tepat discovery in deepwater Block M and holds substantial potential for a gas-condensate discovery, aligning with Shell's gas-focused portfolio strategy in Malaysia.

Following Pekaka, Shell will pursue more ultra-deepwater exploration on Block SB X with the Bijak prospect. These blocks were secured by Shell in Malaysia’s 2021 bid round. Additionally, exploration drilling is anticipated in the shelf region of Sarawak, East Malaysia. Shell is also continuing appraisal activity in Namibian waters to further prove the extent of its significant discoveries, including Graff.

BP also has deepwater exploration plans in Africa and the Americas. The company aims to drill multiple wells in Egypt, including appraisal drilling at the Raven gas and condensate field, as well as wildcat exploration drilling in the King Mariout offshore concession in the Western Mediterranean. BP's Pau-Brazil well marks its first operated well in the Santos Basin off Brazil, expanding its presence beyond the Campos Basin, where it was previously a non-operating partner with Petrobras.

Chevron and Shell are collaboratively spearheading plans to drill off the coast of Suriname in Block 42, which contains the Walker carbonate prospect. A discovery in this block has the potential to catalyze further exploration efforts in Suriname, adding to South America's burgeoning basin for hydrocarbon reserves. Furthermore, Argerich-1, Argentina’s first offshore ultra-deepwater well, in which Shell has a 30% nonoperating stake, if successful, holds a pivotal role in outlining deepwater exploration success for the region.

Follow us on social media: