Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

Note: Total motor gasoline includes finished motor gasoline and gasoline blending components. HGLs=hydrocarbon gas liquids

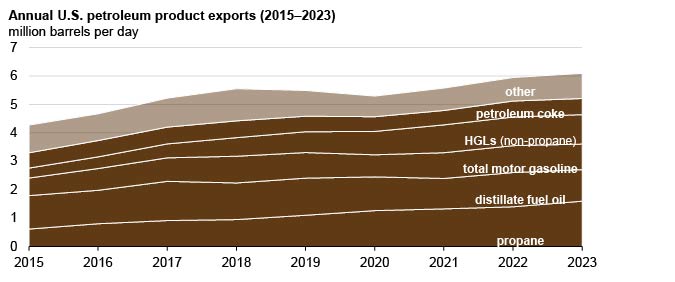

Petroleum product exports from the United States averaged a record 6.1 million barrels per day (b/d) in 2023, a 2.5% increase from 2022, according to our Petroleum Supply Monthly. Propane drove the growth in U.S. petroleum product exports, offsetting decreases in gasoline and distillate exports.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

Note: Mexico accounts for 97% of all U.S. propane exports to North America, and the remainder goes to Canada.

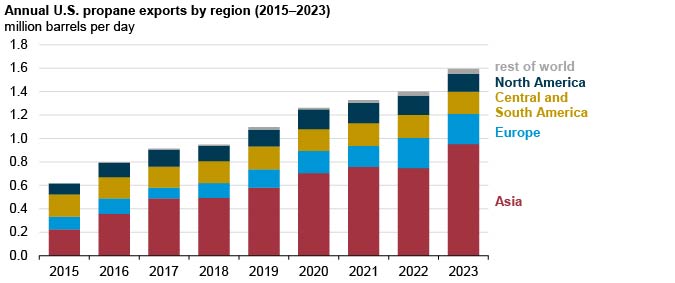

Growing 14% in 2023, U.S. propane exports averaged 1.6 million b/d in 2023, establishing an annual record high. Propane exports made up 26% of all U.S. petroleum product exports, more than any other petroleum product. Propane is consumed globally for space heating and is increasingly used as a petrochemical feedstock in East Asia. Propane consumption as a petrochemical feedstock has been driven by propylene production in East Asia. Propylene is a base chemical used to manufacture polypropylene, a fiber used to make car interiors, packaging, and personal protective equipment.

Annual U.S. propane exports to Asia rose 27% (204,000 b/d) in 2023 compared with 2022. Most U.S. propane exports to Asia went to Japan, South Korea, and China. China accounted for the most growth in U.S. propane exports to Asia, increasing by 50% (72,000 b/d) in 2023.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

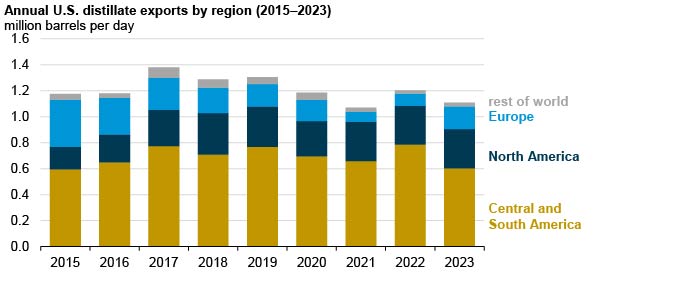

Distillate fuel has been the second-highest U.S. petroleum product export since 2020, after propane. In 2023, U.S. exports of distillate fuel oil decreased by 8% to 1.1 million b/d. The United States typically exports more distillate fuel to Central America and South America than to any other region, which was true in 2023, when the region accounted for 54% of all U.S. distillate exports. Despite the region’s top ranking, U.S. exports of distillate to the region were 23% lower in 2023 compared with 2022, decreasing to 602,000 b/d, the lowest since 2015. Mexico remained the top destination country in 2023, when U.S. exports of distillate averaged 291,000 b/d.

U.S. distillate exports to Brazil declined more than to any other country in 2023, driving the drop in exports to Central America and South America. U.S. distillate exports to Brazil fell 67%, from 136,000 b/d in 2022 to 45,000 b/d in 2023. Trade press reports indicate that Brazil increased distillate imports from Russia. Russia has been looking for destinations outside of Europe to export its oil. Partially offsetting decreasing exports to Brazil, U.S. exports of distillate to the Netherlands grew more than to any other country, rising from 36,000 b/d in 2022 to 62,000 b/d in 2023.

In 2023, total gasoline exports (including finished motor gasoline and motor gasoline blending components) decreased 5% from 2022 and averaged 900,000 b/d. Most U.S. gasoline exports go to Mexico, which was the destination for 56% of all U.S. gasoline exports in 2023. U.S. gasoline exports to Mexico remained essentially flat in 2023, dropping less than 1% and averaging 502,000 b/d. Exports to Brazil fell more than to any other country in 2023, declining 74% (28,000 b/d) compared with 2022. However, overall volumes were relatively small; only 1% of U.S gasoline exports went to Brazil.

Follow us on social media: