Data source: U.S. Energy Information Administration, Drilling Productivity Report, Monthly

Crude Oil and Natural Gas Production Report, and Natural Gas Monthly

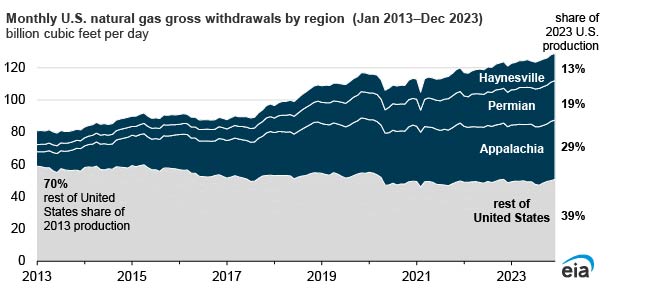

U.S. natural gas production grew by 4% in 2023, or 5.0 billion cubic feet per day (Bcf/d), to average 125.0 Bcf/d, according to our Natural Gas Monthly. The Natural Gas Monthly was recently updated with natural gas production data through December 2023. In 2023, three regions—Appalachia, Permian, and Haynesville—accounted for 59% of all natural gas production in the United States, similar to 2022, based on our Drilling Productivity Report (DPR). The DPR measures gross natural gas withdrawals in select onshore regions.

By contrast, we expect a modest production contraction in 2024; dry natural gas production is forecast to average about 103 Bcf/d, according to our Short-Term Energy Outlook, because of low natural gas prices and a relatively stable rig count.

Data source: U.S. Energy Information Administration, Drilling Productivity Report, Monthly Crude Oil and Natural Gas Production Report, and Natural Gas Monthly

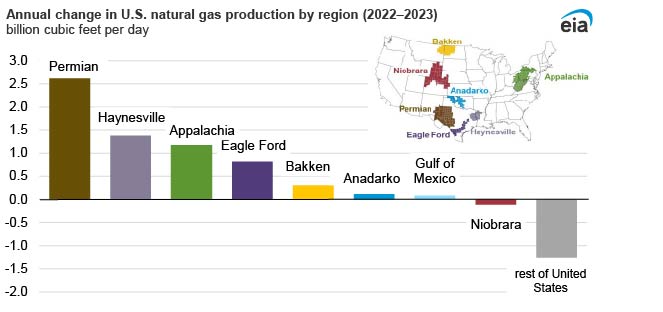

In 2023, more natural gas was produced in the Appalachia region of the Northeast than in any other U.S. region, accounting for 29%, or 37.7 Bcf/d, of gross natural gas production. However, production growth in Appalachia has slowed because the region doesn’t have enough pipeline takeaway capacity to transport more natural gas out of the region to demand markets. In 2022, the Northeast didn’t have any new major pipeline capacity additions. According to our latest pipeline tracker, all interstate pipeline projects in 2023 were for upgrades to existing lines or compressors. In 2023, gross natural gas production in Appalachia grew by 3%, or 1.2 Bcf/d.

The Permian region in western Texas and New Mexico produces the second-most U.S. natural gas, accounting for 19% of production in the United States. In 2023, gross natural gas production in the Permian rose by 2.6 Bcf/d to average 23.3 Bcf/d.

In the Permian region, unlike the Appalachia and Haynesville regions, growth in natural gas production is primarily the result of associated gas produced during oil production. West Texas Intermediate (WTI) crude oil prices remained high enough in 2023 to support oil-directed drilling in the Permian region. The average breakeven price in the Permian region during 2023 ranged from $58 per barrel (b) to $61/b, according to data from a Dallas Fed Energy survey, but WTI crude oil prices averaged $78/b in 2023.

In 2023, the Haynesville region, in Louisiana and Texas, accounted for 13%, or 16.8 Bcf/d, of gross natural gas withdrawals, a 1.4 Bcf/d increase from 2022. In 2022, natural gas production in the Haynesville region had grown by 2.1 Bcf/d. Natural gas production growth in the Haynesville slowed in 2023 because low U.S. natural gas prices decreased rig activity in the region. Producers averaged 49 active rigs per month in the Haynesville in 2023, compared with 55 active rigs in 2022. The higher relative cost to produce natural gas in the Haynesville region played a role in reducing rig activity and subsequently slowing production growth in 2023.

Natural gas production costs depend on many factors, including the cost of drilling wells. The Haynesville formation is 10,500 feet to 13,500 feet deep, which is much deeper than other formations, such as the Marcellus in the Appalachia region, which is 4,000 to 8,500 feet deep. Because the deeper wells make drilling wells in the Haynesville more expensive than in the Marcellus and other shale plays, natural gas prices have to be relatively high to make drilling economical. The Henry Hub spot price averaged $2.54 per million British thermal units (MMBtu) in 2023 compared with $6.42/MMBtu in 2022.

Follow us on social media: