From Louise Dickson, Oil Market Analyst:

The intraday WTI destruction today is certainly epic in scale, which is largely a case of jitters ahead of the WTI May 2020 futures contract expiring tomorrow and storage fears finally materializing. But if you have been watching the physical spot prices in the North Sea, currently trading in the $15-18 range, this drop in WTI May 2020 futures isn’t as shocking.

From Bjornar Tonhaugen, Head of Oil Markets:

The extreme oversupply situation now in April and expected into May is creating huge dislocations for the May 2020 WTI NYMEX contract today in low traded volumes, because the contract has its last trading day tomorrow 21 April on NYMEX. There is probably a squeeze happening right now, while the remaining 21 million barrels of Cushing storage is likely to be filled up into May 2020 at the current pace of stock builds, causing further panic and collapse in the “spot price” for Cushing WTI in low liquidity.

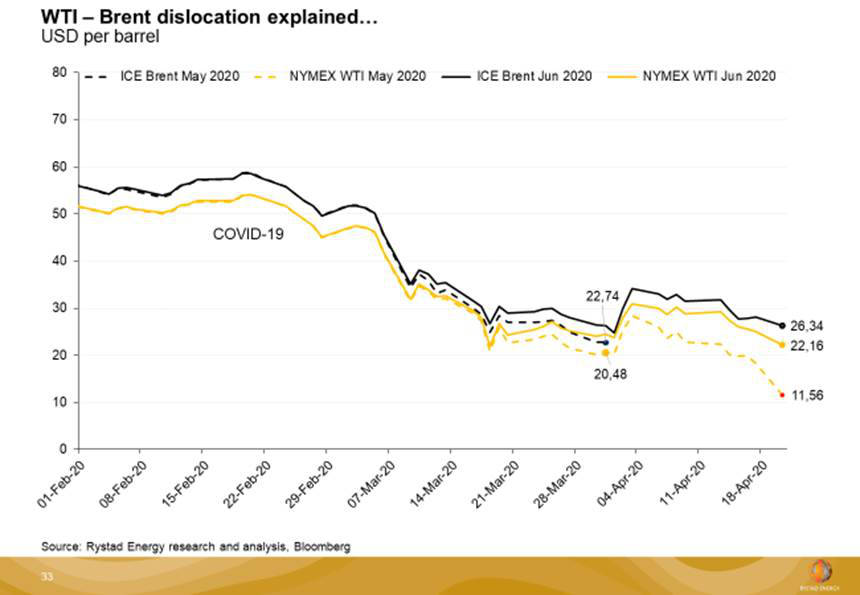

Because the market is severely oversupplied, it at first glance appears as though the WTI-Brent spread also is collapsing, but here it is important to talk about the correct prices and comparisons. Because the Brent futures contract rolls over to the next calendar month (now June 2020) several weeks earlier than the NYMEX WTI front month (still May 2020 delivery!) the “correct” WTI-Brent spread to look at based on the futures trading is now the June 2020 spread. This is more normal around -4 USD/bbl.. The ICE Brent futures contracts rolls on the last calendar day of the month normally (so Brent May 2020 stopped trading on 31 March).

The more accurate WTI-Brent spread to look at now for the prompt (May delivery) would be the physical prices in the North Sea vs. the May 2020 NYMEX WTI. Physical North Sea Dated is trading in the vicinity of 16-17 USD/bbl, so the WTI-Brent spread for “May” is closer to the -4/-5 right now it seems, not -15 USD/bbl which you can get an impression from only looking at the futures prices on the screens now.

Follow us on social media: