Global renewable energy installations broke decade-long industry trends in 2021 as residential solar outpaced commercial and industrial (C&I) capacity and onshore wind installations declined, both for the first time, Rystad Energy research shows.

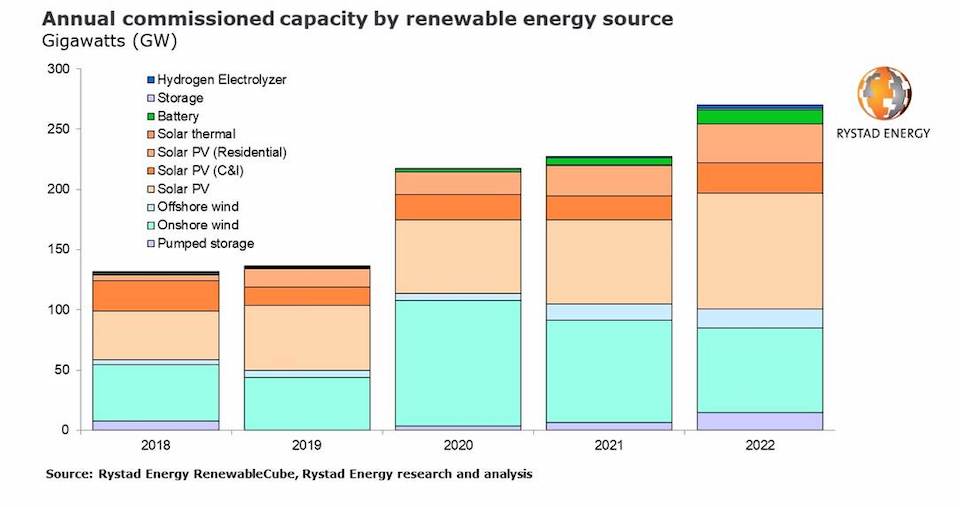

This year has been a record-breaker for renewables globally, with 227 gigawatts (GW) of capacity installed, a 4.7% increase over 2020 levels. Installed utility solar PV, residential solar PV, offshore wind, battery, and other forms of energy storage have all increased in 2021. Utility battery storage set a record high, growing three-fold, while offshore wind installed capacity doubled compared to 2020. Hydrogen electrolyzer capacity also made sizable gains, albeit from a small starting position, reaching 0.8 GW of installed capacity, up from 0.04 GW in 2020. Looking ahead, renewable capacity is expected to skyrocket to over 270 GW of installed capacity in 2022, driven primarily by solar and hydrogen expansion.

“The renewable energy industry is facing some of its most significant challenges yet over the short term, but the future has never looked brighter with new and aggressive commitments from governments and companies alike. The carbon-neutral pledges set forth at the COP26 climate conference in Glasgow this year will help spur major growth in the coming years,” says Gero Farruggio, head of renewables research with Rystad Energy.

Trending Worldwide

Driving the decline in total onshore wind is the winding down of Chinese subsidies, which are projected to cause a 40 GW drop in capacity for the Asian powerhouse, skewing global numbers as a result. Global onshore wind installations are expected to fall to around 85 GW in 2021, a 20 GW drop year-over-year, and a further 15 GW in 2022. However, this trend will likely be short-lived from 2023 onward, as the demand for renewable generation soars to achieve the capacities required for the 1.5 degree Celsius target.

Residential solar PV capacity grew more than 30% in 2021, from 18.9 GW in 2020 to 25.2 GW this year, overtaking C&I solar PV installations for the first time. C&I solar installations fell to 19.9 GW, down from 20.6 GW in 2020. Utility solar capacity installed grew by 15% in 2021, however, it was not the year it could have been – estimates show that 20 GW of utility solar was deferred or delayed during the year. This slow-down in utility-scale projects can be attributed to soaring module costs driven by high component and shipping rates, with total module costs climbing 57% from $0.21 per watt peak (Wp) last year to the current $0.33/Wp. Module prices are projected to rise higher yet next year, peaking at $0.41/Wp in the third quarter of 2022. As a result, up to a further 50 GW of planned solar PV projects starting construction now could be delayed or canceled next year as their economic feasibility dwindles.

Although mergers and acquisitions (M&A) in the renewable sector have ramped up since the onset of the pandemic, the number of post-financial close projects for sale has fallen this year. With project pipeline capacity and global renewable development expertise increasingly desirable, the world’s largest oil and gas majors, including TotalEnergies and BP, plus major renewable developers such as Iberdrola and Enel, continue to show commitment to multi-gigawatt renewable targets. By the end of November 2021, over 195 GW of solar PV and wind project pipeline capacity had been transacted, compared to 14.9 GW in 2020. The top transactions for renewable greenfield pipelines involve large oil companies such as BP and 7x Energy or Repsol and Hectate Energy. Notably, the top pipeline deals involve the acquisition of renewable developers by investment funds such as DIF Capital and ib vogt or JP Morgan’s infrastructure investment fund and Falck Renewables.

Looking Ahead

Continuing the momentum generated in 2020, global giga-scale green hydrogen project announcements have accelerated this year. Including November, a total of 245 GW of hydrogen electrolyzer facilities have been announced worldwide in 2021, six times the levels seen in 2020. A significant portion of the new capacity will come from localized clusters, such as 30 GW in Mauritania and 45 GW in Kazakhstan. Solar PV and wind farms will be attached to these clusters, so these individual sectors will also benefit from increased capacity. Solar PV and onshore wind capacity announcements in 2021 have also snowballed, with both sectors experiencing a four-fold rise compared to 2020 and offshore wind and storage growing three-fold.

Follow us on social media: