Global air cargo volumes fell -4% year-on-year in February as available cargo capacity rose above the pre-pandemic level for the first time in four years, according to the latest weekly market analysis from CLIVE Data Services, part of Xeneta.

Global air cargo capacity increased for the eleventh consecutive month in February, up 11% on the same period last year. The global average air freight spot rate of USD 2.73 per kg declined -35% year-on-year but remained +52% ahead of the pre-Covid level seen in 2019.

Niall van de Wouw, Chief Airfreight Officer at Xeneta, said the latest data means it’s time for the industry to let go of pre-Covid comparisons and to acknowledge a new baseline for air cargo market growth.

“CLIVE Data Services was one of the first industry analysts to benchmark data versus the pre-pandemic level because a comparison was needed at the time to accurately measure air cargo’s performance. But the fascination and rhetoric around airfreight rates going back to the 2019 level needs to be replaced based on the inflationary components we now see. Name me a service or product that you acquired four years ago that you’re still paying the same price for now? The air cargo industry should be focused on where growth is going to come from because the general air cargo volumes have seen negative growth for four years, and based on the first two months of 2023 are still -8% in terms of chargeable weight compared to four years ago. That is not a growth market,” he said, adding 2019 was also a relatively weak year for air cargo after a buoyant 2018.

He added: “The volumes are not there, flights are less full, and more capacity will be coming in April as summer flight schedules commence, so I don’t see fundamental changes that will help the current market conditions. There is a hope and expectation of volumes increasing in Q3 as companies restock, but when I talk to shippers, I don’t hear anyone saying they’re going to ship more airfreight. If restocking comes, many shippers will look firstly to use cheaper modes of transport and, from where we are now, even if there is a boost, we might still be seeing zero overall growth for general air cargo by later in the year.”

The market, he said, will be especially tough for cargo handlers which are dependent on the input of volume.

To mitigate the noises created by the early Lunar New Year this year, CLIVE’s latest global chargeable weight data has also been calculated based on both January and February figures. This showed a -6% year-over-year drop in the first two months of 2023. Global average dynamic load factor, measuring cargo load factor by considering both volume and weight perspectives of cargo flown and capacity available, stood at 57% in February, down 8% pts on the same month last year.

Labor shortages and industrial action continued to present challenges for the global air cargo industry. The recent strikes in German airports on 17 February had a profound impact on air cargo capacity. Outbound Frankfurt cargo capacity on Friday 17 February fell a sharp 60% compared to the week prior.

The air cargo market often sees a surge of flower shipments two weeks prior to Valentine’s Day, as was the case this year, but to a different extent on different trade lanes. Elevated transportation, fertilizer and labor costs, as well as consumers hit by the cost-of-living crisis, dampened cargo volumes from Kenya and Ethiopia to Amsterdam, for example. These were below the levels seen in three of the past four years. However, inflation appears less felt by American consumers as flower cargo volumes from Colombia and Ecuador to Miami stayed strong, outperforming the past four years.

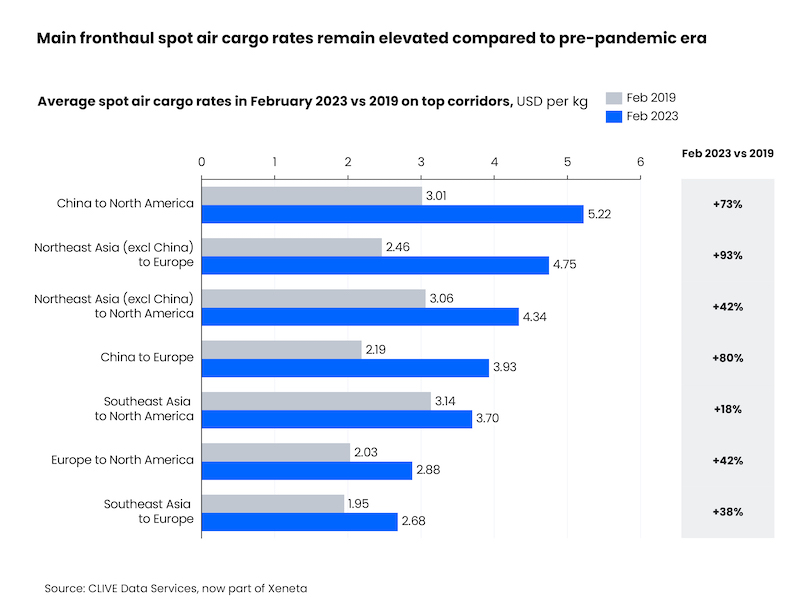

On APAC to Europe, the average spot rate was USD 3.84 per kg in February, down -9% from last month and -48% from a year ago but remained 74% above the pre-pandemic level. At a sub-region level, the February spot rate from Southeast Asia to Europe fell a considerable -63% from last year to USD 2.68 per kg, only 38% above the pre-pandemic level, while spot rates from China and other Northeast Asian regions (such as Hong Kong, Japan and South Korea) remained elevated at USD 3.93 per kg and USD 4.75 per kg respectively. Due to capacity shortage and increased operating costs on these lanes, spot air freight rates were 80% and 93% above pre-pandemic levels.

The APAC to North America spot air freight rate of USD 4.42 per kg in February was down -6% from last month and -60% from a year ago. In comparison to inbound Europe, the spot rate from APAC to North America was only 47% above the pre-pandemic level. As the closure of Russian airspace has limited impact on this corridor, spot air freight rates from Northeast Asia (excl. China) and Southeast Asia were USD 4.34 per kg and USD 3.70 per kg respectively, only 42% and 18% above pre-pandemic levels. But outbound China spot rate remained highly elevated at USD 5.22 per kg, up 73% on the pre-Covid level.

On the Europe to North America corridor, February’s average spot air freight rate was USD 2.88 per kg, a fall of -6% from last month’s level and -40% from a year ago but remained up 42% on the pre-pandemic level.

“The stabilizing market is creating a new baseline. It’s time to let go of pre-Covid comparisons, and we will now reflect this in our own weekly data analysis from March 2023,” van de Wouw concluded.

Follow us on social media: