The bird flu outbreak ravaging global poultry flocks is now the worst since records began, driving a spike in the price of eggs, threatening free-range chicken and risking long-term impacts to animal health.

The avian flu season traditionally begins each October as migratory birds shed infected droppings or saliva while leaving cool areas of the Northern Hemisphere. But this year cases spread rapidly in warmer months, supercharging the virus and prompting mass culls.

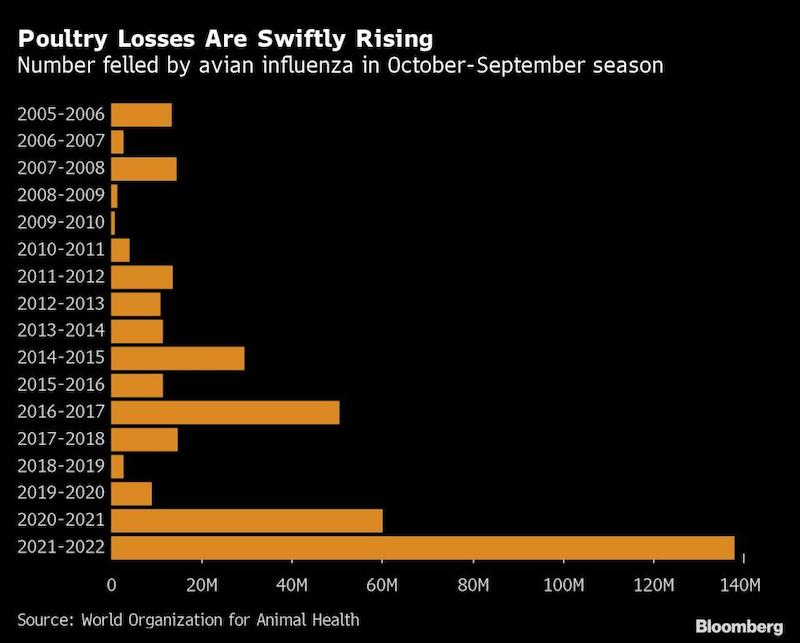

Poultry losses since October are almost 70% above last year’s pace, hitting 16.1 million by Dec. 1, according to the World Organisation for Animal Health. Before then, more than 138 million birds were lost in the 12 months through September, more than the prior five years combined, WOAH said.

In the US, UK and elsewhere it’s led to concerns over seasonal specialties such as roast turkey dinners for Thanksgiving and Christmas. But poultry is a mainstay of global diets, and culls are curbing supplies of products from eggs to foie gras, exacerbating the food inflation that’s hit consumer budgets this year. With vaccines potentially years away, farmers are sounding the alarm.

“This is much, much worse than it’s ever been and I think it’s caught everybody by surprise,” said Mark Gorton, managing director of Traditional Norfolk Poultry in eastern England, which has lost 15% of its flocks since September. “This isn’t just a UK problem, it’s a worldwide problem. We’ve got to sort it out.”

Some 35 billion birds are stocked on farms around the world to meet demand for affordable chicken that has doubled since 1999. This year’s cost-of-living crisis boosted sales further as consumers ditch beef for cheaper options.

The outbreak accelerated just as farmers grappled with rising energy and feed bills. With growth under pressure, global poultry production will probably gain about 1% this year and next, trailing historic norms of 2.5%, said Nan-Dirk Mulder, animal-protein specialist at Rabobank.

Bird flu can spread to tractors or feed and is often fatal to farmed birds, with flocks culled as soon as one falls ill. Chickens grown for meat can be less prone to infection as they are slaughtered after about six weeks, but bigger, older birds and egg-laying hens have been severely affected.

The effect has been to double US retail egg costs in a year, with oven-ready chicken prices in the UK up by a quarter or more.

It’s also a global problem. Malaysia is importing eggs, as feed prices force local farmers to cut back. French farms lost millions of ducks to the flu the past two winters. Minnesota-based Hormel Foods Corp. — which raises turkeys for lunchmeat and roasts — expects output to fall through at least early next year. Importers often restrict purchases from infected regions.

“It’s one big problem on top of all the others,” said Birthe Steenberg, secretary general of European poultry group AVEC.

Since 2021, cases haven’t dissipated in summer like usual, said Gregorio Torres, head of the science department at WOAH. Wild birds are now permanently infected, compromising the health of poultry they encounter and heightening risks for endangered species.

Researchers are trying to understand why, Torres said. The virus evolves quickly, potentially becoming a more effective spreader of disease. The agency is also studying whether climate change plays a role as temperatures warm and migration routes shift.

Yet the virus is not new, and warnings have been sounded before. Highly pathogenic avian influenza has been found on most continents since the mid-1900s. A wave that stemmed from Asia in 2003 caused widespread losses, but that was eclipsed by the toll in 2021-22.

While it can spread to humans, that remains rare, with fewer than 10 people infected by the currently dominant H5N1 strain since 2018, according to the World Health Organization.

Controlling the movement of wild birds is a difficult feat and the scale of recent outbreaks show traditional biosecurity measures, from limiting access to barns and washing vehicles to rapid culls, are “not enough anymore,” Steenberg said.

“Avian influenza is different in 2022 going into 2023 than it’s ever been,” said John Brunnquell, chief executive officer of Egg Innovations, a major US free-range egg producer.

Not everywhere has been badly affected. Outbreaks in Asia have been relatively tame this time around, though Japan detected its earlier-ever case and about two dozen farms were infected in South Korea, which faced egg shortages during past outbreaks.

Brazil, the world’s top chicken-shipper, also remains flu-free, but cases recently cropped up in nearby Ecuador and Colombia, prompting moves to prevent the virus crossing borders.

Consumers are increasingly picky, often choosing free-range products from birds allowed time to roam instead of being cooped up inside. While that’s better for the animals, it heightens the risk of meeting infected wildlife.

As a result, the virus has hurt many outdoor growers. The UK locked down all poultry in November, and 40% of free-range turkeys raised for Britain’s Christmas dinners were killed. The country has also faced egg shortages.

The disease can escalate rapidly, with flocks sometimes wiped out four to five days after initial signs, said Gorton, whose company now won’t fulfil all its Christmas orders. Farms need deep-cleaning after infection and can sit empty for as many as six months. Rapid culling can have a financial impact, too: The UK government only compensates for birds still healthy when officials arrive.

Despite all this, infections haven’t stopped and indoor farms aren’t in the clear. Farmers are searching for fresh solutions, from screens to shield outdoor poultry to scaring off passing birds with bright shining light.

Vaccination trials are under way in Europe, said AVEC’s Steenberg, estimating it could take at least two years for one to reach the market. Any vaccines would need international agreement over standards and require adaptation as strains evolve.

For now, high prices are bolstering poultry farmers, though the risks are accelerating just as swiftly, Mulder said. “Demand is there, but the supply is not,” he said. “It’s an extremely uncertain market.”

In the past, avian flu infections were one-off events, said Brunnquell of Egg Innovations. “The flu came and the flu left. Now, it’s not leaving.”

Follow us on social media: