How much are western sanctions targeting Russia’s petroleum-export machine really hurting Moscow?

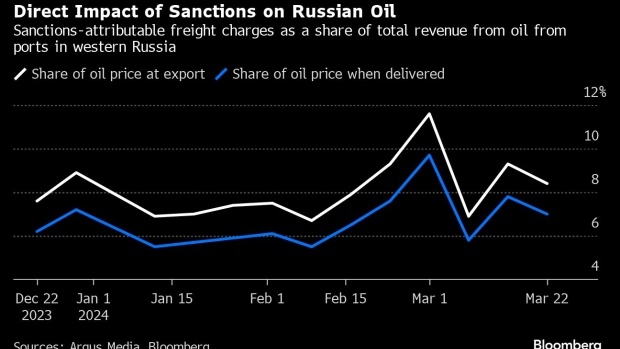

When it comes to exports of crude oil from the country’s western ports, try somewhere between 6% to 8% of the price of a barrel of crude. It’s a level that’s held reasonably steady for the past three months, aside from a spike in late February.

Price reporting agency Argus Media Ltd. produces assessments of actual and baseline costs of shipping oil from different ports in western Russia to Asia and uses those to determine how much is directly attributable to sanctions.

Multiplying those per-barrel assessments by the cargoes on board each class of ship used, it’s possible to get a sense of what the aggregate cost of hiring tankers attributable to sanctions would be. Based on tracking of individual shipments by Bloomberg, that worked out at $773 million since late December.

The barrels in question traded for an aggregate price of $9.6 billion when they left Russia, and $11.7 billion by the time they arrived in Asia, suggesting a sanctions cost of between 6.7% and 8.1% since the week ended Dec. 22.

These figures only reflect the implied sanctions impact on freight. By the time it arrives in Asia, Russian crude also sells at small discounts to international benchmarks. However, there are signs of increased wariness among customers in India when it comes to dealing with Russian-friendly oil tankers.

In practice, Russia also has a large fleet of tankers operating in a so-called shadow fleet. Those ships are unlikely to be charging high per-barrel freight costs but they cost billions of dollars to acquire.

Follow us on social media: