Soybean oil futures climbed to an all-time high in Chicago as global vegetable-oil markets face increasingly strained supplies with Indonesia’s export ban on crude palm oil.

The southeast Asian nation, the top shipper of palm oil, is set to enforce its latest trade policy on cooking oil and related products beginning Thursday. Restrictions will stay in place until domestic prices ease.

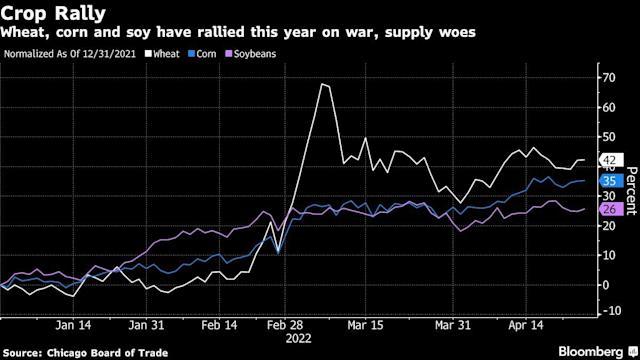

Access to edible oils for making food, biofuels and personal care products is increasingly at risk as war in Ukraine and weather-driven supply woes crimps both supply and trade flow. Indonesia’s move threatens to further drive up costs across multiple supply chains at a time of rampant inflation. It also adds pressure on farmers in big oilseed-growing regions like North America to produce ample crops. The U.S. is already seeing signs of robust demand for future harvests, most notably from China.

“U.S. soybean export sales for next year are off to a flying start,” Jack Scoville, analyst at Price Futures Group Inc. in Chicago, said by phone.

In other oilseed crops, Brazil is dealing with smaller-than-expected yields due to drought, and farmers in Canada are cutting back on canola acres. In Ukraine, most ports have been shut by Russia’s invasion, limiting agricultural shipments from the sunflower-oil heavyweight.

For both oilseeds and grains, there’s concern about adverse weather across the U.S. and Canada slowing plantings of key spring crops. “Little to no field activity” is likely for two or three more weeks after snow storms and sleet, the North Dakota Wheat Commission said Tuesday. And major corn-growing states like Illinois and Indiana were blanketed by cold advisories as of early Wednesday.

“U.S. corn planting, only 7% complete by April 24, is progressing at the slowest pace since 2013,” the Department of Agriculture said in a weather report. “Frost and freezes could threaten temperature-sensitive crops — including blooming fruits and emerged corn — as far south as the middle Mississippi Valley, the Ohio Valley, and the middle Atlantic States.”

Most-active soybean oil futures in Chicago scaled an all-time high, and canola in North America rose to as much as C$1,115.80 per ton, putting prices near the record reached in March.

Corn futures for July delivery in Chicago touched the highest since 2012, rising as much as 2.1% to $8.185 a bushel on Wednesday. July soybeans also edged higher while benchmark wheat fell.

Milling wheat and rapeseed in Paris also rallied. Futures for the oilseed have risen unchecked for months, as the conflict in Ukraine exacerbates already scarce supplies, German oilseed group UFOP said Wednesday.

Follow us on social media: