Global residential heat pump demand will skyrocket in the coming decades as energy efficiency and energy consumption demand take center stage as a result of energy insecurity and decarbonization efforts. Rystad Energy research shows that global heat pump demand could hit 450 million units by 2030, doubling today’s total of around 190 million, and potentially tripling to 1.5 billion by 2050. This forecast is based on Rystad Energy’s 1.6-degree global warming scenario, which we believe is well within reach.

Heat pumps are efficient and flexible, using electricity and refrigerants to draw in warm air during winter and cool air when the temperature rises. They are the most efficient form of space heating and could be crucial in decarbonizing the consumer energy market. Residential heating accounts for roughly 10% of global energy demand, so heat pump systems could considerably impact energy and fossil fuel demand.

However, geopolitical issues, supply chain concerns and additional building renovations that may be required to ensure system efficiency could all throw a spanner in the works.

“Heat pumps could be the magic bullet for reducing demand in the residential energy market and help usher in a greener global energy mix – but significant hurdles stand in the way of reaching these demand forecasts, including the war in Ukraine and tighter regulations, both of which are long-term concerns. If the market can adapt to the evolving landscape and find solutions, heat pumps could be commonplace by mid-century,” says Rystad Energy senior analyst Lars Nitter Havro.

Supply Chain Concerns

One important caveat is that these projections are only likely if the supply chain can support the growth – and that is a big “if”. Heat pumps rely on semiconductor chips, and noble gases like neon, krypton and xenon play a key role in the manufacturing process. The global supply of these gases faces significant challenges due to persisting geopolitical tensions in Eastern Europe. The world was facing a well-documented chip shortage before the conflict, but the war in Ukraine has exacerbated the problem.

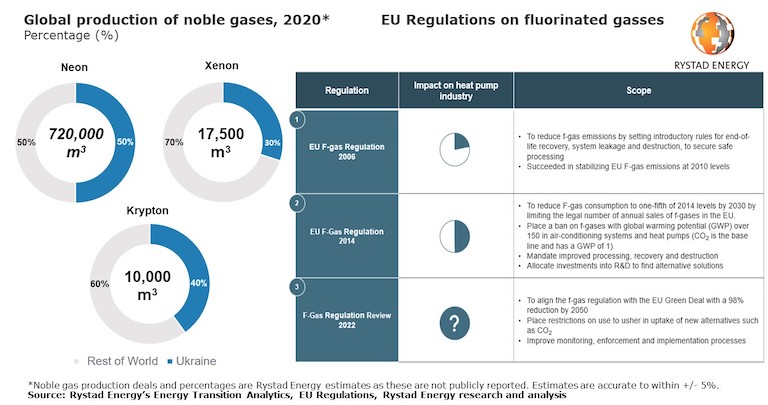

Ukraine is the global leader in noble gas production, accounting for 50% of global neon, 30% of xenon and 40% of krypton production in 2020. Russia’s war in Ukraine has placed most of this production in doubt. As a result of Russian offensives in the Black Sea region, Ukraine’s largest air-separation companies, Cryoin Engineering and Ingas, stopped production in Odesa and Mariupol. These companies account for 50% to 70% of global neon gas production capacity.

Rising electric vehicle demand and other semiconductor-heavy segments have added to the pressure on production lead time. Semiconductor lead time climbed to an all-time high of more than 27 weeks in May from an average of 13 weeks in 2019. Production hub Taiwan plans to ramp up output, and with China and Russia as runner-up chip suppliers, Western countries are eagerly searching for additional sources to tackle the shortage.

Hurdles Ahead

Heat pump systems also rely on hydrofluorocarbons, classified as F-gases or fluorinated greenhouse gases. These are potent greenhouse gas emitters with a global warming potential up to 25,000 times greater than carbon dioxide (CO2), raising questions about how “green” the systems are in practice. There is a real threat of stricter regulation on F-gas emissions, particularly from the European Union (EU).

The current set of EU restrictions was adopted in January 2015, adding a quota system and several prohibitions designed to cut emissions by two-thirds by 2030 over 2014. Under the current regulations, EU member states must phase down production and consumption of F-gases to one-fifth of 2015 levels by 2030. However, newly proposed legislation from the European Commission targets an even more aggressive approach, with a 98% reduction target by 2050, should it become law. Considering the leading role the EU has played in climate-related regulation, it is reasonable to assume that other governments would follow suit and instigate similar measures.

This means that alternatives to F-gases are needed, and the most promising options for heat pumps are natural refrigerants like propane and CO2. Propane is considered one of the most ecologically compatible refrigerants, and also benefits from thermodynamic properties comparable to existing F-gases. CO2 is another good option because it can be sustainably sourced and operates effectively at low ambient temperatures, making heat pumps a potential offtake sector for the growing carbon capture market.

Both these alternatives have drawbacks, however. Propane poses a risk of flammability when used in pressurized confined spaces, while CO2 has a lower efficiency in higher temperatures. Regardless of the potential impediments to these alternatives, current F-gases are set for inevitable phase-out, meaning other solutions will need to play a vital role in future heat pump systems. For example, re-combining F-gases could be a viable alternative, such as a hydrofluorocarbon-hydrochloro-fluoro-olefin (HFC-HFO) blend consisting of hydrogen, fluorine and carbon. HFC-HFO blend is a non-compromising alternative with thermodynamic properties similar to existing F-gases. Accordingly, novel HFC-HFO blends may play a role in the transition towards natural refrigerants. In any event, the supply chain will have to rely on continued supply of F-gases in the short term and research and development efforts providing new alternatives in the near term in order to accommodate the necessary expansion of the heat pump market.

To add another hurdle into the mix, heat pump systems, while effective at sub-optimal temperatures, only function correctly in well-insulated buildings. This means additional renovations to improve insulation may be required to ensure efficiency.

Follow us on social media: