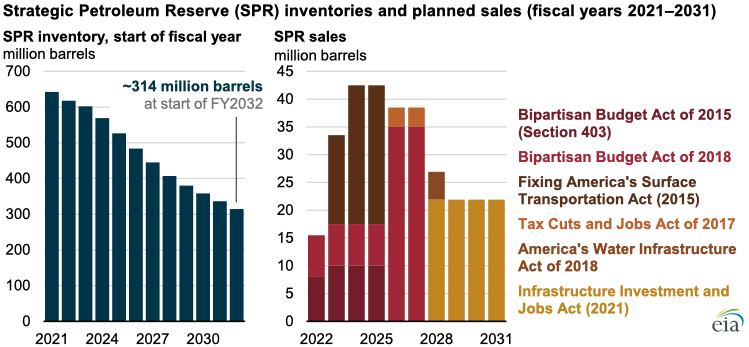

On Tuesday, November 23, the White House announced plans to make 50 million barrels of crude oil available to the market through a combination of exchanges and accelerating previously announced sales. With these sales and several other legislated drawdowns, SPR inventories could decline from 618 million barrels (as of October 1, 2021) to about 314 million barrels by the start of the 2032 fiscal year, the lowest level since March 1983. The Infrastructure Investment and Jobs Act, passed earlier this month, includes a provision to draw down 87.6 million barrels of crude oil from the U.S. Strategic Petroleum Reserve (SPR) in fiscal years (FY) 2028 through 2031.

The SPR was established in the 1970s to alleviate the effects of unexpected oil supply reductions. The reserve was designed to hold up to 714 million barrels of crude oil across four storage sites along the Gulf of Mexico, where much of the U.S. petroleum refining capacity is located.

Crude oil can be released from the SPR under four conditions: emergency drawdowns, test sales, exchange agreements, and nonemergency sales. Emergency drawdowns and test sales are relatively rare. The most recent emergency drawdown occurred in 2011 in response to production disruptions in Libya, and the most recent test sale occurred in 2014. The SPR has released crude oil under exchange agreements 12 times since 1996, most recently after Hurricane Harvey in 2017. In these exchange agreements, crude oil is released to private companies and repaid in kind by specified dates with additional barrels, similar to monetary interest on a loan.

Congress has also authorized nonemergency sales of SPR crude oil to respond to lesser supply disruptions or to raise revenue for the U.S. Treasury. For example, the Fixing America’s Surface Transportation Act, passed in 2015, and The Bipartisan Budget Act of 2018 collectively call for the sale of more than 160 million barrels of crude oil from the SPR in FYs 2022 through 2027.

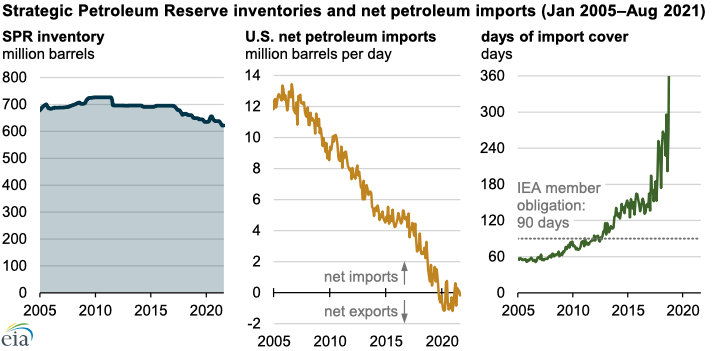

One of the SPR’s core missions is to hold enough oil stocks to fulfill U.S. obligations under the International Energy Program, the 1974 treaty that established the International Energy Agency (IEA). As a member of the IEA, the United States is obligated to maintain stocks of crude oil and petroleum products, both public and private, to provide at least 90 days of U.S. net import protection. The U.S. Department of Energy calculates this value by dividing the SPR inventory level by EIA’s sum for net crude oil and petroleum product imports.

As net imports of crude oil and petroleum products into the United States declined in recent years, the volume needed to meet the 90-day import coverage also fell. In October 2019, the United States exported more crude oil and petroleum products than it imported, becoming a net exporter for the first time in EIA data, which dates back to 1977. IEA members who are net petroleum exporters do not have stockholding obligations. Although the United States has occasionally imported more petroleum than it exported in some months since late 2019, SPR inventory levels have continued to provide sufficient coverage for net import protection.

Principal contributor: Owen Comstock

Follow us on social media: