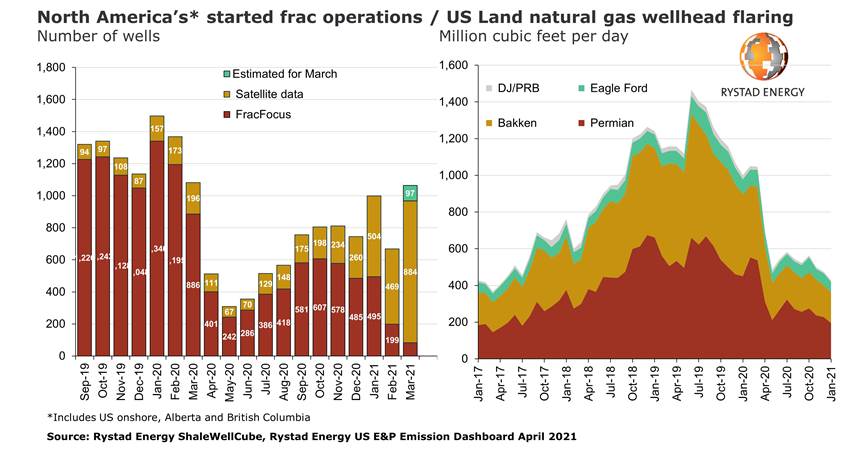

Fracking in North America has almost recovered to pre-pandemic levels, with the count of started frac jobs reaching a 12-month high in March 2021, a Rystad Energy report shows. The number of completed wells in the Permian basin during the first quarter of 2021 exceeded the required output maintenance level, so oil production is set to rise in the current quarter – but will likely slow again later in the year.

Rystad Energy has already registered 967 started frac operations in North America for March 2021. As satellite data coverage is incomplete for the past few days, we estimate that about 97 jobs are yet to be detected if the running rate of frac activity is maintained in the remainder of the month. This will bring the final count for March to about 1,064 wells – exceeding the January 2021 activity level by about 6.5%.

Nearly all major basins are positioned for at least production maintenance in the second quarter of the year, or even some sequential production growth, as is the case with the Permian. The only exceptions are the Bakken and Anadarko regions, where operators may still struggle to cope with the base decline this quarter.

It has to be mentioned, however, that the March frac count for the Niobrara may be overestimated. While the growth in fracking activity is real, the current value is driven by detection of fracking activity on several large pads. We believe that some frac operations on these pads will in reality be spread out across several weeks during March and April.

“The Permian was disproportionally hit by the Texas winter crisis in February and activity in the region grew significantly in March. We have already detected 429 started frac operations in March, while February 2021 ended up at 260 wells. Permian oil production maintenance currently requires about 300 unconventional well completions per month, so the basin is set for production growth already in the second quarter,“ says Artem Abramov, head of shale research at Rystad Energy.

If we look at weekly frac job counts, however, we can see that frac rates are now trending downwards from March’s impressive recovery numbers. The two-week average frac count has dropped from over 100 in mid-March to 65 currently – which is below the production maintenance level. If this trend continues, the Permian production recovery in the second quarter might not be long-lasting.

In other oil regions, monthly frac activity has been fluctuating between 200 and 230 wells per month since October 2020, and this trend is not changing. The two-week average frac count grew from 51 during week 12 to 63 in week 13.

Flaring

Gas production and disposition reporting for January 2021 is now nearly complete, and we can conclude that associated wellhead gas flaring in major US liquids regions (Permian, Bakken, Eagle Ford and DJ/PRB combined) posted another sequential decline in the first month of the year.

We have seen structural declines in gas flaring since early the fourth quarter of 2020, despite a significant recovery in frac activity. This trend emphasizes the industry’s commitment to gradually eliminate routine flaring and develop tight oil resources in an environmentally responsible manner.

As of January 2021, only 5.7% of gas was flared in the Bakken, whereas Permian flaring intensity fell to 1% – the same intensity as in the Eagle Ford regions, which historically have flared much lower shares of gas than the Permian.

When complete February 2021 data is published, we anticipate that we will see a temporary increase in Permian gas flaring as satellite data reveals a clear spike during the period of winter crisis. Yet it appears that gas flaring declined again in March in both the Permian and the Bakken, and we will most likely see a reported flared gas volume for March similar to the January level.

On a quarterly basis, despite a temporary increase in February 2021, we estimate that Permian total gas flaring (upstream and midstream) declined from 300 million cfd in the fourth quarter of 2020 to 270 million cfd in the first quarter of 2021 – the lowest level since 2017.

All Permian sub-basins on the Texas side are seeing sequential declines in wellhead gas flaring, while Delaware North (New Mexico) is the only major area with a modest increase, from 43 million to 45 million cfd. In fact, gas flaring in the Delaware North has gradually risen since 2020’s second quarter as activity and production levels on the Permian’s New Mexico side have remained exceptionally robust.

While wellhead gas flaring intensity is going down structurally in the Permian, some trends indicate that certain operators may be moving faster than others when it comes to ESG (environmental, social and governance issues). Private operators in the Permian accounted for about 25% of gross gas production in the basin as of 2020’s second half, but were responsible for 55% of wellhead gas flaring.

This implies that the average private operator has three to four times higher flaring intensity in the Permian than its public peers. As public producers have gradually switched to more disciplined capital programs and introduced structural changes to their gas flaring policies, they have reduced their contribution to basin-wide gas flaring from 70% in early 2018 to 45% in the second part of 2020, while their share of basin-wide gross gas production was relatively unchanged.

Follow us on social media: