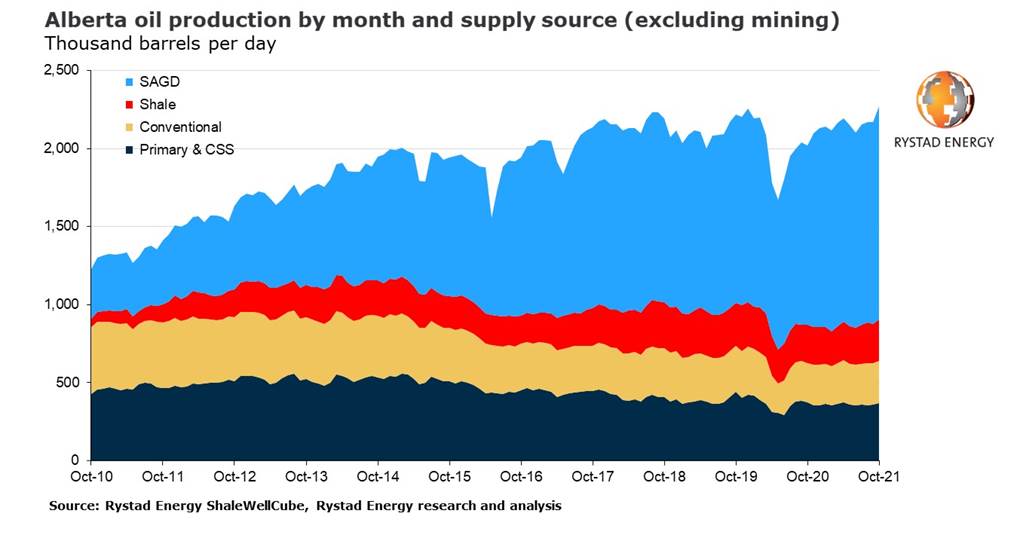

Oil production from non-mining processes in the Canadian province of Alberta hit an all-time high in October 2021, averaging 2.27 million barrels per day (bpd), marginally topping the previous record of 2.25 million bpd set in December 2019, a Rystad Energy report shows. Contrary to the structural shift towards lighter barrels in the US Gulf Coast market, the composition of upstream supply in Alberta is the heaviest in modern history.

Output in October 2021 jumped a staggering 103,000 bpd month-on-month, driven primarily by increases in steam-assisted gravity drainage (SAGD) production, which accounted for more than 70% of the monthly growth. Compared with the previous record, SAGD volumes reached 1.36 million bpd in October 2021, a 150,000 bpd increase from December 2019.

In contrast to the rise in SAGD production, output from other supply sources in the province still lagged the previous record. Light oil and lease condensate delivered around 268,000 bpd in October 2021 compared to 288,000 bpd in December 2019. Conventional production averaged 271,000 bpd, while primary & cyclic steam stimulation (CSS) heavier barrels averaged 367,000 bpd in October – a drop of between 12% and 13% compared with December 2019.

“Such a dramatic monthly increase is exceptional and typically only occurs when the region’s production is reactivated following curtailments, but no such hurdles were lifted this time. However, the new high set in October is unlikely to hold the record for long, as seasonal trends mean even greater production levels are expected in November and December,” says Artem Abramov, head of shale research at Rystad Energy.

Among the largest SAGD operators, Cenovus Energy and Suncor Energy were the most significant contributors to recent growth, delivering 529,000 and 252,000 bpd, respectively, in October 2021, compared to 476,000 and 209,000 bpd, respectively, in December 2019. Other notable SAGD players include ConocoPhillips, Canadian Natural Resources and MEG Energy, all of which have produced all-time high levels at some point during 2021.

Production is yet to return to pre-Covid-19 pandemic highs in the light oil and lease condensate shale plays in Alberta, including the Montney and other tight gas and tight liquids operating areas. However, a sustainable positive trajectory is ongoing, with output climbing gradually from around 220,000 bpd in early 2021 to the current level of almost 270,000 bpd.

The number of put-on-production (POP) shale wells in the first 10 months of this year totaled 994, corresponding to an around 45% recovery in POP activity levels compared to the comparable period of 2020 and a full recovery towards activity level observed in 2019. The nature of the activity recovery witnessed in 2021 has resulted in a lopsided POP schedule weighted towards the second half of the year. The share of full-year POPs in the last two months of 2021 is expected to be greater than the equivalent time in 2017 to 2020. On a full-year basis, a 50% year-on-year growth in the Alberta shale POP market is expected.

What lies ahead?

While POP activity has returned to 2019 levels this year, drilling activity in 2021 has already surpassed 2019 by a healthy margin. By year-end, an estimated 1,525 shale wells will have been spudded in Alberta in 2021, a level that has not been seen since 2018 and exceeds the annual level of POP activity by around 400 wells. While US tight oil producers have primarily focused on drilled but uncompleted (DUC) well inventory this year, their Alberta counterparts have laid a foundation for future growth, delivering significant new inventory build-up that will support POP market expansion in 2022 and almost certainly continue the province’s upward trajectory. Much of the drilling activity growth in 2021 came from privately owned operators, which shut down almost entirely during the downturn in 2020 but delivered around 255% growth in spud activity level this year, compared to 65% growth for public producers.

Follow us on social media: