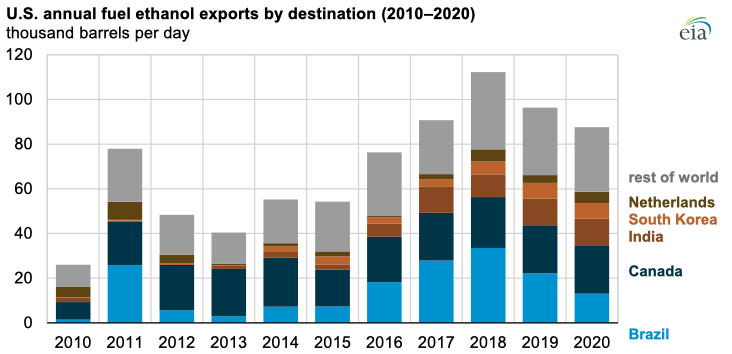

The United States exported 87,000 barrels per day (b/d) of fuel ethanol in 2020, marking the second consecutive annual drop in U.S. fuel ethanol exports and the lowest level since 2015. U.S. fuel ethanol imports also decreased in 2020. In 2020, the United States exported more fuel ethanol than it imported for the 11th consecutive year.

Annual U.S. fuel ethanol exports fell by 9% in 2020. At the same time, the number of export destinations increased from 44 in 2019 to 52 in 2020. Approximately 40% of all U.S. fuel ethanol exports went to Brazil and Canada, although both countries decreased their imports of fuel ethanol from the United States compared with 2019.

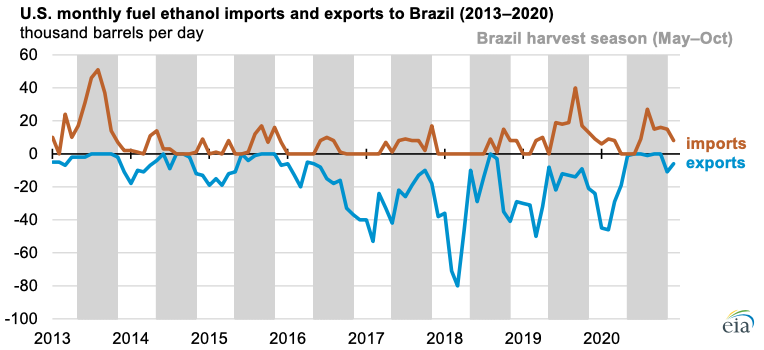

Brazil, the world’s second-largest producer and consumer of fuel ethanol, decreased its imports of U.S. fuel ethanol significantly for the second consecutive year, dropping to 13,000 b/d in 2020. Ethanol consumption is high in Brazil because of its fuel ethanol blending requirement, which is currently set at 27%, and demand for hydrous ethanol (E100), which competes with traditional gasoline blends. Brazil primarily produces fuel ethanol from sugarcane. As a result, Brazil produces most of its fuel ethanol during the sugarcane harvest period (May through October). Brazil’s imports of U.S. fuel ethanol typically peak in between harvest seasons.

The United States and Brazil are trade partners for fuel ethanol. The United States decreased its sugarcane fuel ethanol imports from Brazil in 2020 to 9,000 b/d, down 4,000 b/d from its 2019 level. U.S. fuel ethanol imports from Brazil all entered the United States through California because of the fuel’s favorable treatment compared with domestic corn ethanol under California’s Low Carbon Fuel Standard (LCFS). According to the LCFS scoring system, Brazil’s sugarcane ethanol emits less carbon dioxide than U.S. corn ethanol sources.

U.S. exports of fuel ethanol to Brazil declined in 2020 mostly as a result of uncertainty related to Brazil’s tariff-free quota, Brazil's responses to COVID-19 that decreased fuel demand, and the depreciation of the Brazilian real against the U.S. dollar. All U.S. fuel ethanol exports to Brazil face a 20% Brazilian tariff since the tariff-free fuel ethanol quota expired on December 14, 2020. This recent change will likely lower U.S. fuel ethanol export volumes to Brazil in the near term.

Canada surpassed Brazil in 2020 to become the top destination for U.S. fuel ethanol exports. Canada’s average of 21,000 b/d of fuel ethanol imports has remained largely unchanged over the past few years. The third-largest destination in 2020 for U.S. fuel ethanol exports was India, followed by South Korea and the Netherlands. The remaining 47 destinations received approximately one-third of U.S. fuel ethanol exports.

Principal contributors: Estella Shi, Sean Hill

Follow us on social media: