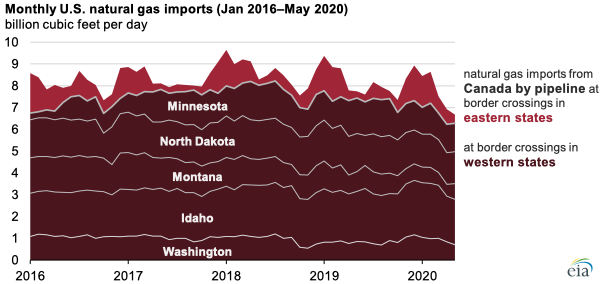

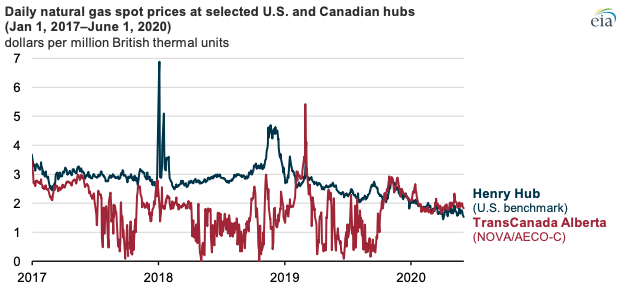

U.S. imports of natural gas by pipeline at U.S.-Canada border crossings in the western United States fell to an estimated average of 6.2 billion cubic feet per day (Bcf/d) in April and 6.3 Bcf/d in May 2020, according to Genscape pipeline flow estimates. Imports by pipeline into these western states account for most U.S. natural gas imports and tend to be less seasonal than imports by pipeline in the eastern United States. In recent months, natural gas spot prices in Alberta, Canada—where nearly all of Canada’s natural gas is produced—have been higher than spot prices at the U.S. natural gas benchmark Henry Hub.

Natural gas spot prices at the NOVA/AECO-C (AECO) trading hub in Alberta, Canada, have ranged between $1 per million British thermal units (MMBtu) and $2/MMBtu below Henry Hub spot prices from mid-2017 until late 2019. However, from October 2019 through March 2020, there was little difference in spot prices at those two points. In April and May 2020, AECO natural gas spot prices increased, even as many other natural gas prices (including Henry Hub) fell.

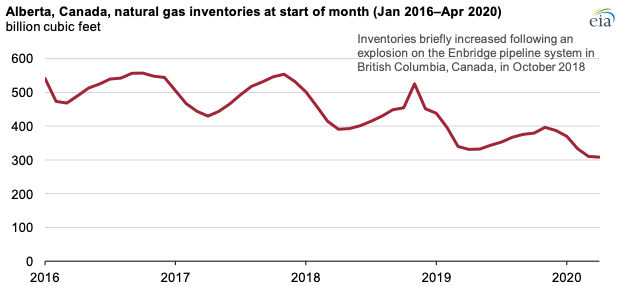

Price movements at the AECO hub over the past several years reflect regulatory changes to Western Canada’s pipeline operations. In August 2017, TransCanada (now TC Energy) changed operations on its NOVA system, prioritizing firm-service customers and stopping deliveries to interruptible customers—which include storage operators—during maintenance periods. This change made the AECO natural gas spot price more volatile and reduced injections into natural gas storage in Alberta.

In late September 2019, the Canadian Energy Regulator approved a temporary service protocol (TSP) for the NOVA pipeline system, which allowed additional service flexibility during maintenance periods and, in particular, allowed deliveries to storage facilities during periods when the system is constrained. Shortly after the TSP approval, the difference between AECO spot prices and Henry Hub narrowed.

As in the United States, natural gas inventories in Canada typically hit seasonal lows in the spring because natural gas is withdrawn from storage in the winter months to meet higher demand for natural gas heating. In March and April 2020, Alberta’s natural gas inventories were at multiyear lows of slightly more than 300 billion cubic feet.

These operational changes in Western Canada’s natural gas pipeline system and narrowing differences in spot prices have resulted in less natural gas being exported to the United States, especially at border crossings in Montana and North Dakota. Natural gas imports in Montana and North Dakota in the first five months of 2020 averaged 0.4 Bcf/d and 0.3 Bcf/d less, respectively, compared with the first five months of 2019.

According to its most recent Short-Term Energy Outlook, the U.S. Energy Information Administration (EIA) expects gross imports of natural gas by pipeline into the United States—more than 99% of which come from Canada—to fall from 7.4 Bcf/d in 2019 to 7.0 Bcf/d in 2020 and then increase to 7.9 Bcf/d in 2021. EIA’s forecast of 7.0 Bcf/d in 2020 would be the lowest level of annual U.S. natural gas imports by pipeline since the mid-1990s.

Principal contributor: Katie Dyl

Follow us on social media: