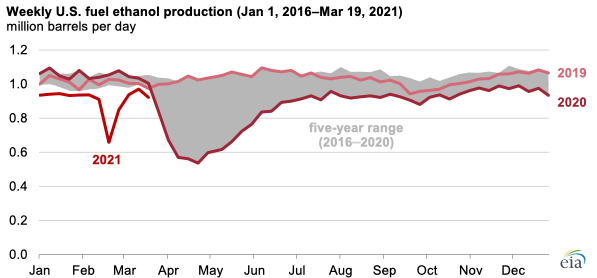

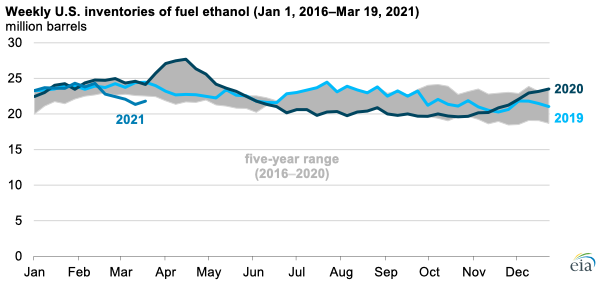

The colder-than-normal weather that affected much of the United States in mid-February and disrupted Midcontinent and Gulf Coast petroleum markets also affected fuel ethanol producers. Fuel ethanol production fell to the lowest levels since the onset of responses to COVID-19 in spring 2020. U.S. weekly fuel ethanol production fell to an average of 658,000 barrels per day (b/d) during the week of February 21, 2021, which was the lowest weekly production level since May 11, 2020, and 38% lower than at the same time last year, according to EIA's Weekly Petroleum Status Report. Production rates have since returned to average levels, but fuel ethanol inventories remain lower than their typical seasonal averages heading into the summer driving season.

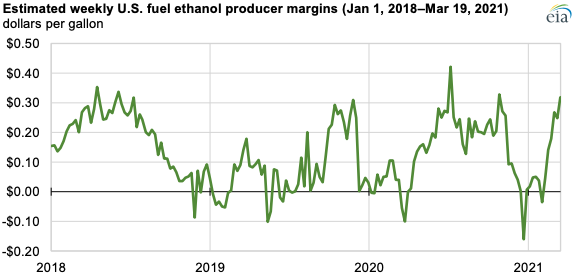

Fuel ethanol operating margins and production rates are largely driven by fuel ethanol, corn, and natural gas prices. Estimated fuel ethanol margins fell to negative levels in February, when natural gas supplies were disrupted and natural gas spot prices approached near record-high levels. As a result, many fuel ethanol producers reduced production rates. Amid record-high natural gas prices, some fuel ethanol producers chose to sell natural gas supplies back into spot markets instead of producing fuel ethanol. U.S. weekly fuel ethanol production has since increased to an average of 922,000 b/d for the week ending March 19, but fuel ethanol inventories have yet to fully return to average levels after the supply disruption.

U.S. weekly inventories of fuel ethanol fell to 21.3 million barrels as of March 12, 2021, which marked the fourth consecutive weekly inventory withdrawal at a time when inventories typically build as we head into the summer driving season. The March 12 inventory level was 13% less than at the same time last year and the lowest inventory level since November 27, 2020, when fuel ethanol production and inventories began increasing after reaching five-year lows, which occurred as a result of responses to COVID-19. Fuel ethanol prices and producer margins have since returned to average levels. Elevated prices for fuel ethanol Renewable Identification Numbers (RINs) should also help drive higher fuel ethanol production rates and prompt fuel ethanol inventories to build closer to their normal seasonal averages in the coming weeks, as evidenced by the slight increase to 21.8 million barrels as of March 19, 2021.

Principal contributors: Sean Hill, Estella Shi

Follow us on social media: