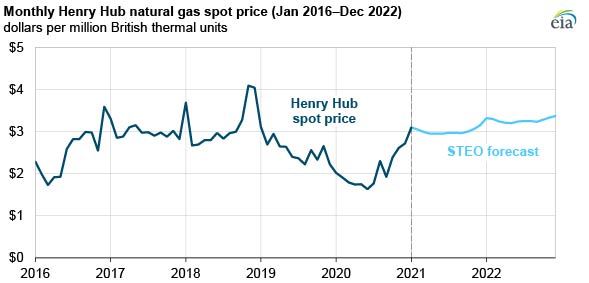

n its January 2021 Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) forecasts that the annual natural gas spot price at the Henry Hub will rise 0.98¢ per million British thermal units (MMBtu) to average $3.01/MMBtu in 2021. EIA expects higher natural gas prices will prompt dry natural gas production to increase in the second half of 2021, after reaching a monthly low of 87.3 billion cubic feet per day (Bcf/d) in March 2021. On an annual basis, EIA forecasts that dry natural gas production will decline from an average of 90.8 Bcf/d in 2020 to 88.2 Bcf/d in 2021. Since early 2020, natural gas production has fallen amid low natural gas and crude oil prices.

EIA expects that U.S. natural gas consumption will decline by 2.3 Bcf/d to 80.8 Bcf/d in 2021. The decline is primarily driven by a 3.5 Bcf/d decrease in natural gas consumed in the electric power sector because of higher natural gas prices. Higher natural gas prices would lead to natural gas-to-coal fuel switching and to more competition from renewable generation sources from expected renewable capacity additions in 2021. EIA forecasts natural gas consumption in the electric power sector to decline by another 1.7 Bcf/d to average 26.4 Bcf/d in 2022.

EIA expects slight increases in natural gas consumption in the industrial, residential, and commercial sectors because of expected economic growth (based on IHS Markit economic forecasts) and slightly cooler winter weather (based on National Oceanic and Atmospheric Administration forecasts).

EIA expects natural gas exports to continue to exceed natural gas imports in both 2021 and 2022. EIA forecasts that in 2021, natural gas pipeline exports and liquefied natural gas (LNG) exports will be nearly equal: exports by pipeline increase 0.6 Bcf/d to 8.6 Bcf/d and LNG exports increase 2.0 Bcf/d to 8.5 Bcf/d.

Follow us on social media: