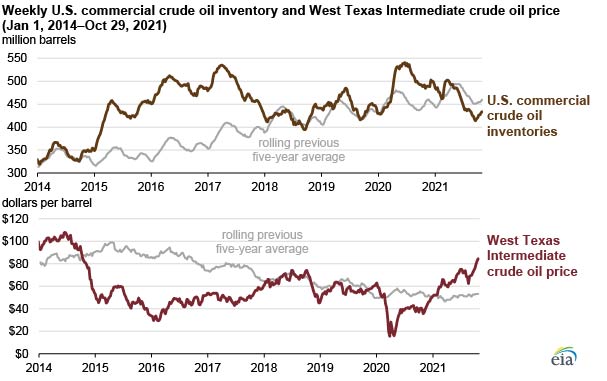

The price of U.S. benchmark West Texas Intermediate (WTI) crude oil is near its highest level since 2014, increasing rapidly from low prices in mid-2020. Because of the economic effects, government and business responses, and personal travel changes caused by the COVID-19 pandemic in 2020, demand for crude oil and petroleum products declined rapidly, inventories increased, and prices fell.

The demand decrease in the first half of 2020 resulted in increasing crude oil inventory levels. U.S. crude oil inventories were 440.3 million barrels at the end of January 2020 and increased to 532.7 million barrels by the end of June 2020. U.S. crude oil inventories, however, returned to pre-pandemic levels, falling to 438.9 million barrels in July 2021, which is below inventory levels in January 2020. Crude oil inventories reached a recent low of 413.9 million barrels during the week of September 17, but they increased to 434.1 million barrels during the week of October 29.

This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019. Demand has grown faster than supply, reducing inventories and contributing to higher prices for crude oil and petroleum products. The price for WTI reached $84 per barrel (b) on November 1, up $37/b since the beginning of the year. Likewise, the price of Europe's crude oil benchmark, Brent, rose $34/b over the same period, reaching $85/b on November 1.

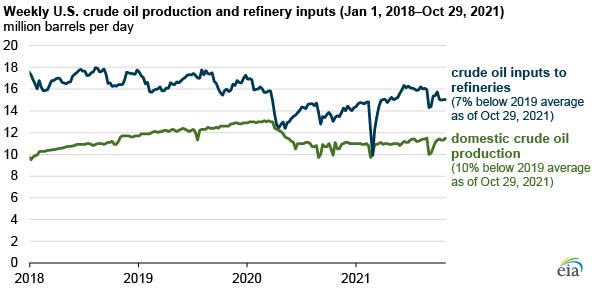

Refineries use crude oil as a feedstock to produce petroleum products. Refineries have increased operations (increasing their demand for crude oil) at a faster rate than U.S. crude oil production has increased this year, contributing to the decline in U.S. crude oil inventories. U.S. crude oil inputs have nearly returned to the 2019 level for this time of year, despite several refinery closures since 2020.

Follow us on social media: