Vietnam’s production of robusta coffee likely shrank this year to the smallest in four years as farmers focused more on growing durians and their attention was drawn away by a local property boom.

The harvest fell more than 7% from the previous year to 1.67 million tons, according to the median estimate of exporters and traders in a Bloomberg survey. Crop expectations gradually declined as the harvest progressed.

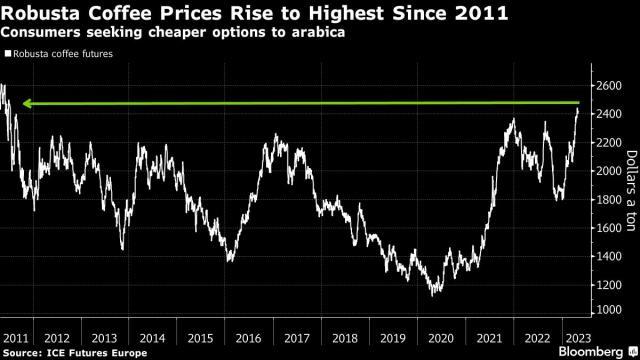

The global market for robusta beans — the type used in instant drinks — has grown as roasters and consumers seek cheaper options to cope with high inflation. Prices have also been supported by worries about the impact of weather on some key crops. That’s driven futures for the variety up 36% this year in London to the highest level in more than a decade.

“Actual output was lower than people had forecast,” said Phan Hung Anh, chief executive of exporter Quang Minh Coffee Trading in the southern Vietnamese province of Binh Duong. “Growers invested less in their coffee farms because their eyes were fixed on growing durians and other profitable fruit.”

Another coffee shipper, Le Duc Huy, general director of Simexco Daklak, said the smaller harvest was explained by a down year in the crop production cycle, increases in fertilizer costs and a property boom early last year, which pulled some growers away from their farms.

The reduced crop and strong demand spurred a surge in local coffee prices to 53,000 dong ($2.26) a kilo last month, the highest since at least 2014. Farmers have sold over 85% of their crop and exports have been running at a fast clip.

The country shipped 1.16 million tons of coffee in the first seven months of the season, the highest ever, according to customs and statistics office data compiled by Bloomberg. But the pace may slow over the rest of the season.

Robusta futures rose for a third day, adding as much as 1.3% to $2,455 a ton.

Follow us on social media: