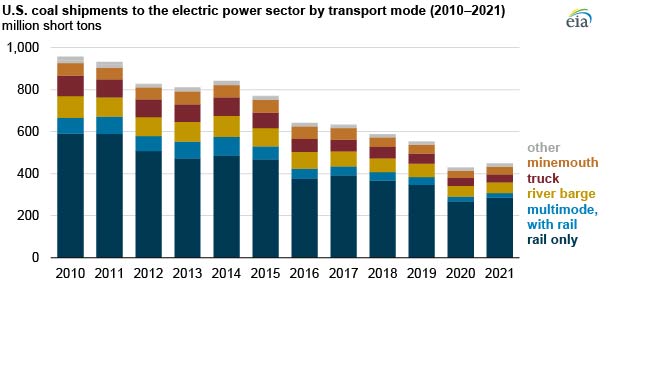

U.S. power plants received 449 million short tons (MMst) of coal in 2021, less than half of the 957 MMst they received in 2010. Coal shipments to U.S. power plants declined over the past decade as coal-fired generation in the country fell and coal-fired power plants shut down.

Although coal shipments have been trending down over the past decade, 2021 shipments increased 5% from 2020 because coal-fired generation increased. In 2021, coal-fired generation rose for the first time since 2014 because of higher electricity demand and higher natural gas prices versus relatively stable coal prices.

A power plant’s location and the cost-efficiency of the shipping method primarily determine how it receives its coal. Minemouth coal-fired power plants—or plants that are built beside coal mines—receive coal directly from the adjacent mine, usually through a long conveyor belt. Minemouth shipments accounted for 8% of coal shipments to power plants in 2021, compared with 6% in 2010.

For non-minemouth plants, coal must be transported from coal mines to the plant. Coal can be transported to power plants via freight railroad, river barge, truck, or a combination of these shipping methods. Although shipments have declined since 2010, the mix of shipping methods used to transport coal to power plants has largely remained the same.

More coal is transported over the extensive U.S. freight rail network than any other shipping method; around 70% of the coal delivered to U.S. power plants in both 2021 and 2010 was shipped either completely or in part by railroad. Although more expensive on a per-ton basis than truck or river barge, freight rail has been the most cost-effective way to move large volumes of coal over the long distances between mines in remote regions to coal-fired power plants, which are usually located near electricity customers.

Because so much of the coal delivered to U.S. power plants is transported by railroad, widespread or sustained disruptions to the country’s rail network can cause significant delays in coal deliveries to power plants. In September 2022, a dispute between freight rail companies and labor unions over a new worker contract nearly resulted in a nationwide strike that would have shut down freight railroad tracks, halting coal shipments. A strike was averted when a tentative agreement was reached just hours before the deadline.

River barges are typically the lowest-cost way to transport large amounts of coal over long distances, but their use is limited to the relatively few coal-fired power plants located on navigable rivers. Barges accounted for 11% of coal shipments to power plants in both 2010 and 2021.

Shipping coal entirely by truck is only cost-effective over short distances or for smaller shipments; this mode is generally used when a mine or plant doesn’t have direct rail or barge access and is relatively close to a supplying mine. Truck-only shipments accounted for 9% of coal shipments to power plants in 2021, compared with 10% in 2010.

You can find more information about coal transportation, including shipments by transport mode, origin, and destination, in our summary of coal transportation costs. Additional information from our coal and electricity industry surveys is available in our interactive coal data browser and electricity data browser.

Follow us on social media: