China’s biggest wave of steel exports since a global glut in the mid-2010s is inflaming trade tensions across the world as the metal reaches a wider range of destinations.

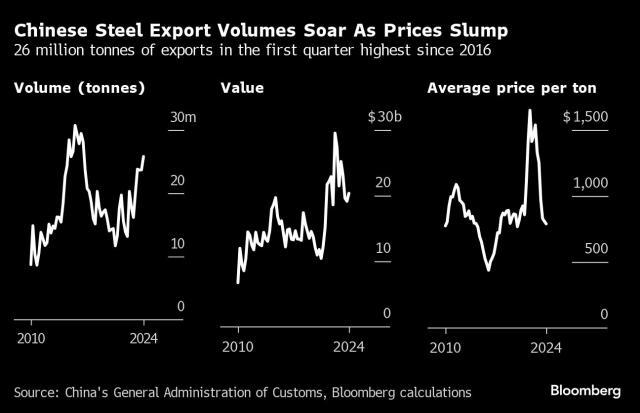

The world’s biggest producer shipped out nearly 26 million tons in the first quarter — 28% more than a year earlier — as the property crisis sapped domestic demand. East Asia is still the major market, but shipments to India, the Middle East and Latin America are on the up.

The soaring exports are worsening trade frictions around the world. President Joe Biden is calling for tariffs of as much as 25% on certain Chinese steel products. While the US takes very little steel from Asia’s largest economy, it’s part of a broader move by Washington to push back against what it says is Chinese overcapacity across industries from metals to solar.

Further south, steel exports to Brazil jumped 29% in the first quarter from a year earlier, and shipments to Colombia and Chile climbed 46% and 32%, respectively, according to Kallanish Commodities. All three countries have launched or are preparing trade measures to tackle the surge. Chilean steelmaker Cap SA reversed a decision to shutter its mills after the government imposed tariffs on some Chinese products.

China has churned out about 1 billion tons of steel every year since 2019, but a rapid downturn in construction activity over the past year has left mills struggling. Many have switched from making construction products like reinforcement bar to hot-rolled coils that find readier buyers in other industries, as well as overseas.

Steel analysts have also said that China’s exports of hot-rolled coil are being fueled by a tax scam that effectively allows Chinese traders to trim VAT payments and make even cheaper export offers. A senior official from the China Iron & Steel Association last week called for a crackdown on illegal exports last week, without elaborating.

Chinese steel exports to Egypt shot up by 95% in the first quarter, while those to the United Arab Emirates jumped by 81%. The latter country is now the third-biggest destination for Chinese steel after Vietnam and South Korea.

Follow us on social media: