IBA, the award-winning aviation advisory and analytics company, has today published its latest monthly Aviation Carbon Emissions Index in association with KPMG. This month’s index also includes a spotlight on ABS efficiency.

New data found that CO2 emissions from the commercial aviation industry averaged 144 grams per-seat per-mile in April 2022, with overall carbon intensity (total CO2) per-seat decreasing by just under 0.5%. This represents a 2.5% reduction in total CO2 emissions year-on-year per-seat per-mile.

April 2022 saw global traffic growth remain steady since March, with month-on-month growth reaching 2.2%. This growth was driven by a 13.5% increase in international flights originating within Europe & CIS. 75% of these flights used high density narrowbodies operated by the top three low-cost carriers in Europe; helping to drive down overall CO2 intensity per-seat per-mile.

Ryanair, Lufthansa, Turkish Airlines, Wizz Air and easyJet were the operators that drove the increase in European international flights, and these airlines account for over 36% of the entire European international flight network. In contrast, global domestic flights experienced a 3.2% decrease in April.

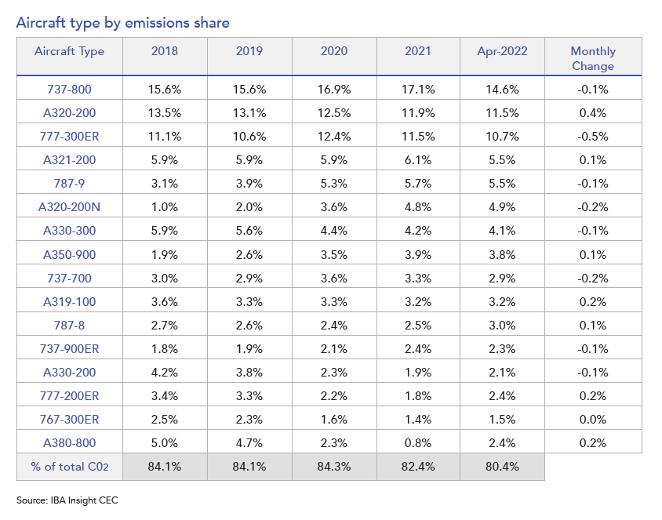

Aircraft Efficiency Spotlight

The global share of emissions in April 2022 shifted slightly, with the Airbus A320-200ceo experiencing a 0.4% increase on the previous month. The Boeing 777-300ER saw a decrease in its monthly share. Flight data from IBA Insight has identified a continued month-on-month increase, which itself is driven by growth elsewhere in the global fleet mix. IBA expects this growth to continue as deliveries of these types ramp up.

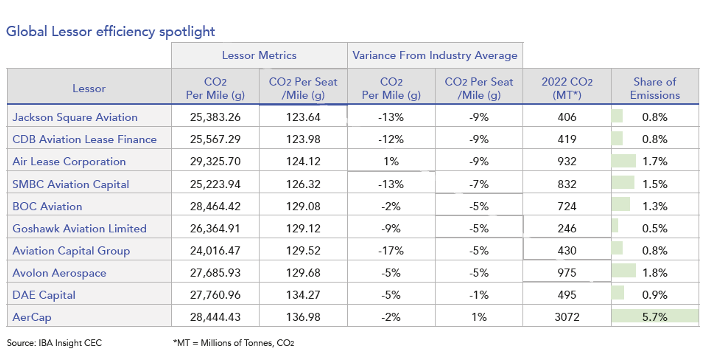

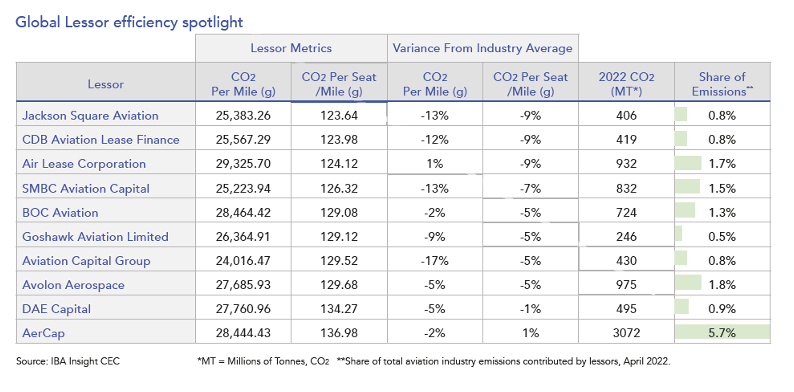

Lessor Efficiency Spotlight

There has been little change in CO2 emissions from lessors this month, with CO2 per-seat per-mile figures remaining at an average of 129 grams. Jackson Square Aviation remains at the top of the lessor efficiency index in April. Overall CO2 emissions per-seat and per-mile are likely to fluctuate marginally month-on-month for each lessor.

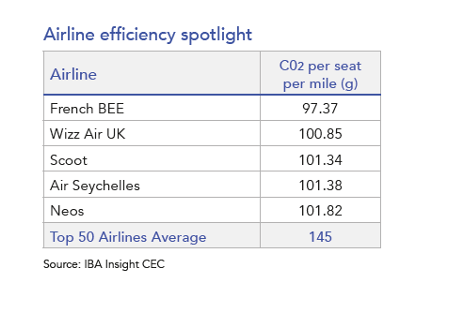

Airline Efficiency Spotlight

April 2022 saw changes in the Airline Efficiency Index, with Wizz Air UK re-entering the ranking. Their fleet utilises a 55%/45% split between the A320neo and A320ceo aircraft and consists of 16 active aircraft owned and managed by a mix of entities. These include BoComm Leasing, Carlyle Aviation Management Limited and AVIC Leasing.

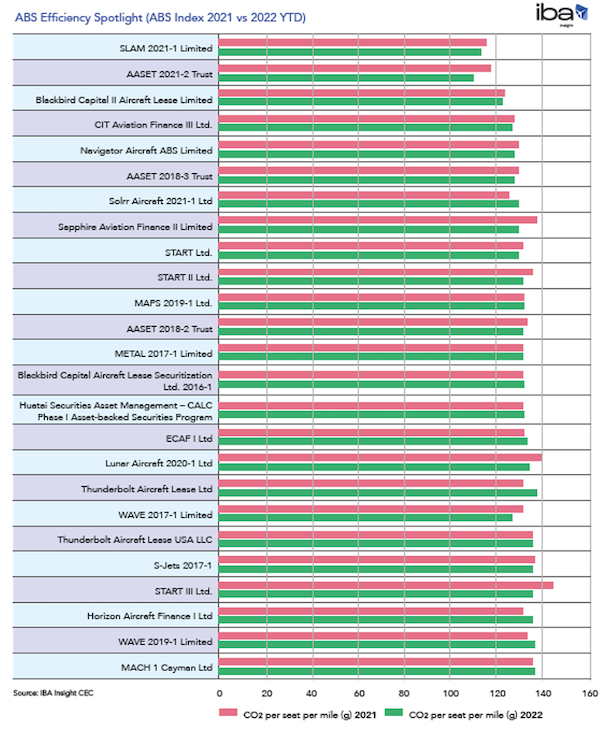

ABS Efficiency Spotlight

Most of the strong performers in the ABS efficiency ranking are based on ABS transactions made in 2021. These mostly consist of new generation and high density narrowbody aircraft. One example was SLAM 2021-1 Limited, which included a blend of 8 x Airbus A321-200neo, 3 x Boeing 737-900ER, and 1 x Airbus A330-900 aircraft. The composition of aircraft within this ABS lends itself to a good efficiency rating due to most of the A321-200neo aircraft being in high-density, single class configuration.

Another notable entry in the ABS efficiency ranking is the Navigator Aircraft ABS from November 2021, managed by DAE Capital. This consisted of 22 aircraft with an average age of 6.7 years. This ABS structure includes high-density Airbus A321-200neo aircraft operated by Indigo.

IBA has also identified ABS’ that follow a more typical trend of asset composition. One such example came from Sapphire Aviation Finance II Limited, with an average asset age of 10.4 years. This ABS consists of aircraft mostly operating for Eastern European and Russian operators, and benefits from A330ceo aircraft with high density dual class layouts, helping drive the overall efficiency rating on the portfolio.

Chris Brown, Head of Strategy at KPMG, said: “We don’t yet see it impact the narrowbodies or widebodies until the 2030s, leaving the ABS market as a viable market for the near future. However, there are two key risks here.

“First, SAF supply is immaterial at present and needs to rapidly ramp up - the demand is already there, even at existing price premiums, so the investment attention needs to turn more to power-to-liquid technologies at scale that will have captive markets. Without this supply side investment, expect increasingly harsh scrutiny for conventional aircraft.

“Second, we currently model hydrogen and electricity’s total contribution to aviation’s energy needs as still under 10% of total by 2050, ramping up since the late 2030s. If hybrid, fuel cell and other technologies accelerate and become commercially viable for retrofits, then regional, narrowbody and even widebody assets will face midlife decisions not previously factored in.”

In IBA’s next issue, it will examine Enhanced Equipment Trust Certificates (EETCs), identifying key deals and the carbon intensity of those arrangements.

IBA Insight flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Follow us on social media: