By now anyone who listens to the news knows about the challenges within the global supply chain. Last year we saw the effects of pent-up demand as we moved into the post pandemic phase which overwhelmed the global container fleet and the spillover effect it had on the multipurpose vessels/heavylift (MPV/HL) sector. While the surge has seen some pullback during 2022 there remains some flashing red lights as we move into the summer.

China’s zero tolerance COVID policy has caused major disruptions in several major Chinese container ports. This is coupled with the upcoming peak season surge for U.S. imports and an ILWU labor contract expiring at the end of June. These events are all cause for concern for any short- term relief on the supply chain pressures. While rates have had some pullback in the last few months there is no guarantee that this trend will continue. These conditions make it almost impossible for shippers to project future freight expenditures without even mentioning the word inflation.

The MPV/HL sector is expected to continue with a global fleet contraction which began prior to the COVID-19 pandemic. While there has been some moderate orders for newbuilds the past few years, these orders will primarily be used to replace older tonnage that is now exceeding 20 years of service. Financing of newbuilds remains difficult for some owners but has improved from the pre-COVID environment when it was very difficult to invest in the MPV sector. The real challenge with newbuilds is finding available building slots in shipyards. Most yards prefer to build larger and simpler container and bulk ship designs. Over the next three years the global MPV/HL is not expected to see any significant change to the current number of vessels now in service.

Cargo Spillover

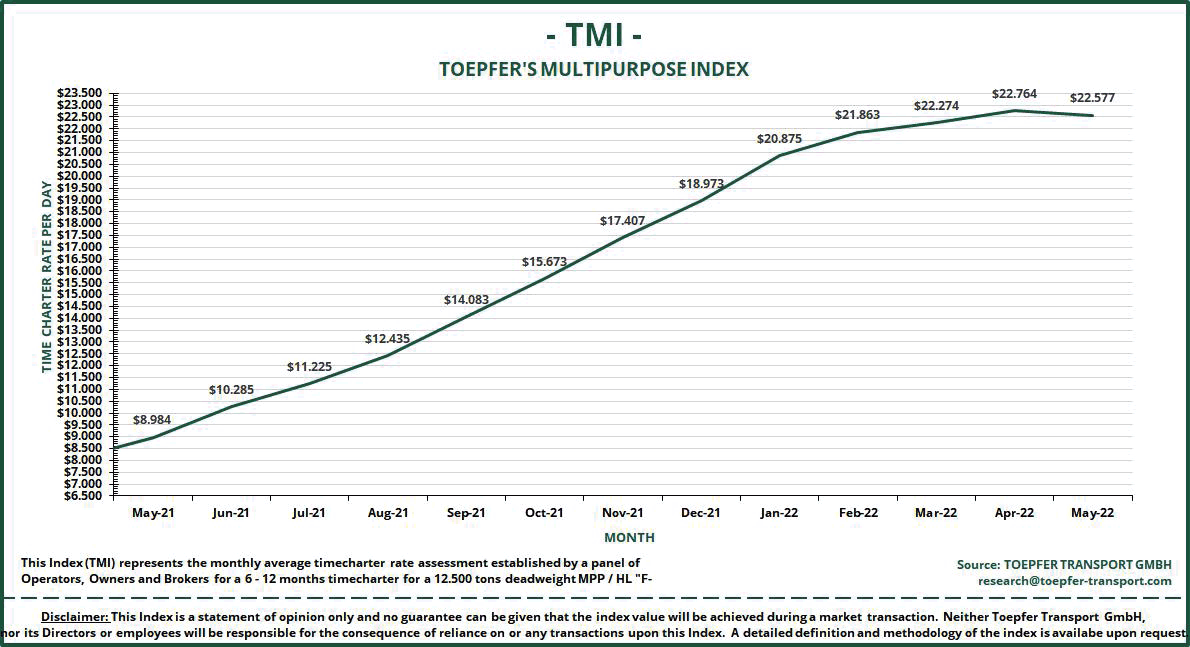

We expect some spillover cargo from container carriers to continue throughout the year and into 2023 but volumes are not expected to remain at the levels seen this past year. However, the forecast looks quite positive for the MPV/HL owners related to traditional project cargoes such as the windpower, energy and mining sectors. High commodity prices and demand are expected to keep these sectors performing at high levels. The Toepfer Multipurpose Index (TMI) supports the current short supply of tonnage as daily charter rates on a 12,000 dwt vessel has risen from $8000.00 per day to almost $23,000.00 in the last 12 months alone.

If the current supply chain crisis within the container segment was not cause enough for concern, the Russian invasion of Ukraine has also shown how intertwined the global supply chain really is. I’ll cite one example from each country.

Russia’s war in Ukraine has also had a severe impact on global trade and supply chains. Ukraine produces about half of the global supply of neon gas and is currently at a production standstill. Neon gas is a critical component for laser tools used in the production of microchips. This will further impact those industries that are already dealing with critical supply shortages in what continues to be a global shortage of microchips. Russia on the other hand is one of the world’s largest producers of ammonium nitrate used primarily as fertilizer for agricultural and as a blasting agent in the mining industry. Even prior to the invasion Russia had instituted a quota restriction on the exports of ammonium nitrate. Currently, Russian exports have ceased resulting in the global price of this commodity having more than doubled in recent months. If this shortage remains in place it will directly impact the agricultural industry and result in lower planted acreage and reduced crop yields. This of course will lead to even higher prices on consumers, who unfortunately are always the last link in the supply chain.

Just prior to the COVID-19 outbreak the shipping industry was facing new regulations regarding fuel and emissions standards known as IMO 2020. A beginning step toward reducing Co2 emissions from ocean going vessels. At the time it, was considered to be a game changing event for the industry and a significant financial burden on the part of shipowners. The reality is that the industry and clients adapted with little fanfare or outcry as the pandemic slammed us shortly thereafter. More stringent regulations introduced by the IMO will continue with new incremental emissions standards for vessel owners through 2030. While many believe the container and cruise industry will benefit from increased use of LNG and other alternative cleaner fuels. The nature of how MPV fleets operate throughout the world will most likely keep them married to dirtier oil-based fuels. As a result, slow steaming may become a regular part of a voyage in order to meet the future IMO emissions standards. Longer time at sea will mean higher operating expenses for owners, vessel operators and shippers.

Follow us on social media: