A vigorous recovery from the global aerospace industry has increased demand for nickel, a key aircraft component prized for its corrosion resistance, high strength and exceptional mechanical properties. This could inadvertently complicate or delay new energy infrastructure developments by diverting metal supply from critical sectors such as upstream, offshore and liquefied natural gas (LNG) terminals, which use nickel for various equipment applications in extreme environments.

Aerospace customers procuring high volumes at premium prices are further extending lead times and increasing spot prices of these materials, particularly in Europe and the US. According to Rystad Energy analysis, this has led to an upward trend in nickel pricing risks for the next 12 months despite a downward trend in raw material prices overall.

The use of high-nickel superalloys is typically lower in energy applications than in the aerospace sector, with lower individual order volumes and a heavier project dependency. Limited available supply for smaller orders has doubled prices since the first quarter of this year from already elevated levels.

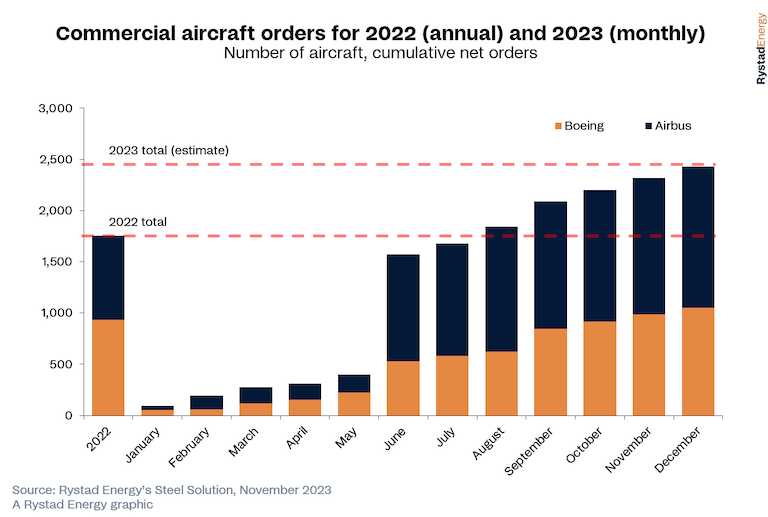

Orders for new aircraft have risen again following the widespread resumption of global travel after the Covid-19 pandemic, with Boeing and Airbus expected to finish this year with more than 2,400 new orders combined – a 40% increase compared to 2022. This is driven by strong orders from United Airlines, Ryanair, Riyadh Air, IndiGo and Air India. IndiGo's order of 500 A320 units in June was the largest single purchase agreement in the history of commercial aviation.

In addition to material procurement for commercial aircraft, defense expenditure is expected to increase in 2023, expanding further due to enduring geopolitical tensions.

“Raw material costs have declined, but limited supply for smaller orders has driven prices up since the start of the year. With mill lead times continuing to lengthen significantly, prices are only likely to rise further, even as material prices remain low. As such, if new facilities require these superalloys, players must solidify delivery schedules and procure early where possible to ensure they save cost and meet projected deadlines,” says Matt Loffman, senior vice president at Rystad Energy.

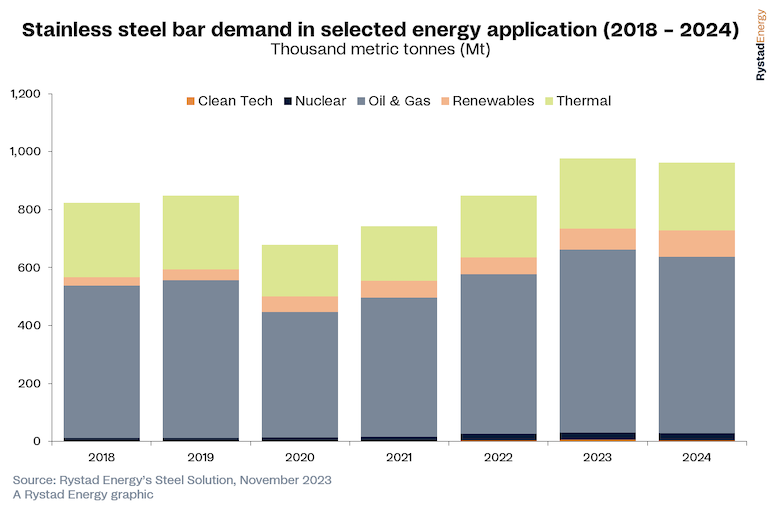

The demand for high-nickel alloy bars within the upstream energy sector can be challenging to quantify, often depending on specific projects. This challenge is partly due to the substantial costs of these materials, which can exceed $60,000 per tonne. In the global refining, chemical, power and LNG sectors, which collectively require close to 1 million metric tonnes of stainless-steel bars, it is estimated that only around 2,500 tonnes of high-nickel alloy bars will be utilized in 2023. However, this demand is poised to grow as several factors come into play.

High-nickel bars represent a niche but indispensable segment of the stainless-steel bar market. They find applications in critical and demanding scenarios, where attributes such as high strength, corrosion resistance and temperature tolerance are paramount. These high-nickel alloy bars are utilized in diverse settings, ranging from valve assemblies in petrochemical plants to rotating equipment in power generators and nuclear reactors.

Despite their relatively modest market share, high-nickel bars are essential to numerous industries. As industries increasingly grapple with the challenges posed by higher volumes of sour gas processing, installing higher-temperature thermal facilities, matched against the backdrop of rising project activity in the LNG and nuclear power generation sectors, signifies the importance of high-nickel bars and their application in future projects.

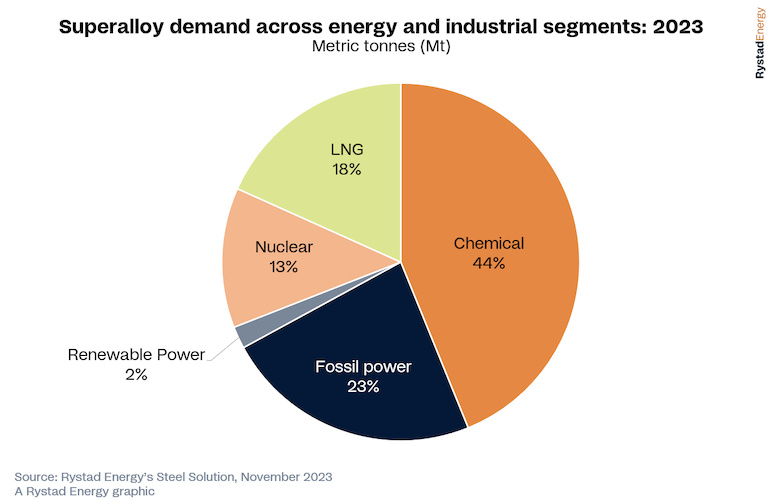

Global production capacity for these specific bar grades is challenging to quantify because the vacuum induction melting (VIM) or vacuum arc remelting (VAR) furnaces can produce other grades, and output for each mill can vary even when the furnace theoretical capacity is identical. Our latest estimate is approximately 20,000 metric tonnes of global accessible production capacity, which means that the downstream and power sector is a small proportion of the overall demand for these materials, significantly smaller than aerospace.

Aerospace original equipment manufacturers typically represent the lion’s share of accounts for large manufacturers. A large part of this is due to mills themselves benefitting from larger order volumes and higher margins.

If new facilities, including soon-to-be-commissioned LNG plants, require these superalloys, assessing their latest supply capacities and pricing movements may reduce project costs by millions of dollars. LNG terminals and offshore wind turbines are also expected to drive additional volumes where seawater corrosion and stress corrosion cracking are concerns.

Monitoring these niche products can cause a ripple effect in terms of time and trade, which must be managed to balance supply and demand.

Follow us on social media: