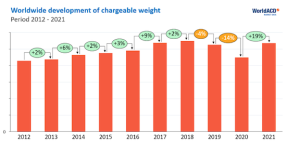

To put the air cargo industry’s performance in 2022 in perspective, we have looked at the worldwide development of chargeable weight in the last 10 years. As shown in the chart below, in the period from 2012 to 2018 the Year-on-Year (YoY) growth for chargeable weight was a single digit positive percentage for each of the years, with an average annual growth of +4%. The YoY change in 2019 was -4%, followed by -14% in the first covid year 2020. In 2021, the worldwide air cargo business bounced back with a +19% increase, bringing 2021 above the 2019, but below the 2018 level.

With the first 2 months of 2022 being +2% above 2019 and also 2% above 2021, there were high hopes for a gradual increase of air cargo business in 2022, but the world changed with Russia’s invasion of the Ukraine. Our database shows a worldwide YoY weight change of -3% for March 2022 compared with March 2021. The lockdown in China also had a big impact with -13% on outbound air cargo and -23% on inbound air cargo business for China. However, we should point out that business from China South East (incl. Guangzhou, Shenzhen and Xiamen) was up +18%, compared with -29% from China East (incl. Shanghai).

When we further look at March on a country level, we observe that for 74 of the 155 countries for which WorldACD publishes individual data, we find negative outbound growth. That means there were still more countries with positive volume growth. See world map below.

Our figures for Eastern Europe show that YoY air cargo imports stood at -38%, and air cargo exports at -15% in March 2022. From the worldwide region-to-region markets, Europe to/ from Asia Pacific was hit hardest in March, as one would expect given the developments on both ends of this market: weight was down -20% eastbound and -29% westbound

The Americas did best in March 2022 and Q1 2022. Both North America and Central & South America have seen high single digit growth figures, for outbound as well as inbound air cargo volumes in this period.

In terms of product categories, we see quite some differences in performance in Q1 2022. Live Animals, Vulnerables/High-Tech and Perishables contracted, whereas Pharma, Dangerous Goods, Express and Valuables increased. The latter three categories had even seen double digit growth compared with Q1 2021.

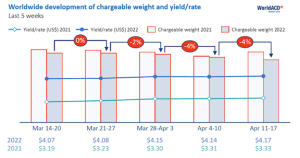

The average worldwide USD yield/rate in Q1 2022 was 29% higher compared with the same quarter a year earlier. In Jan, Feb and Mar 2022, the YoY yield/rate changes were up +37%, +23% and +28% respectively (measured in USD/kg). Looking at our latest figures, for the first half of April, we do not see a change from the trends in March: yields have steadily increased week-on-week, and chargeable weight has dropped with -7% in the last two weeks (Mon 4 Apr - Sun 17 Apr) compared with the preceding two weeks (Mon 21 Mar - Sun 3 Apr) and with -6% compared with 2021.

Follow us on social media: